Advertisement|Remove ads.

Nvidia Stock Dips Into Correction Zone, But Wall Street Predicts 'Breakout' Q3 — Can Jensen Huang Crush The ‘AI Bubble’ Talk?

- The consensus calls for third-quarter adjusted EPS of $1.25 and revenue of $55.03 billion.

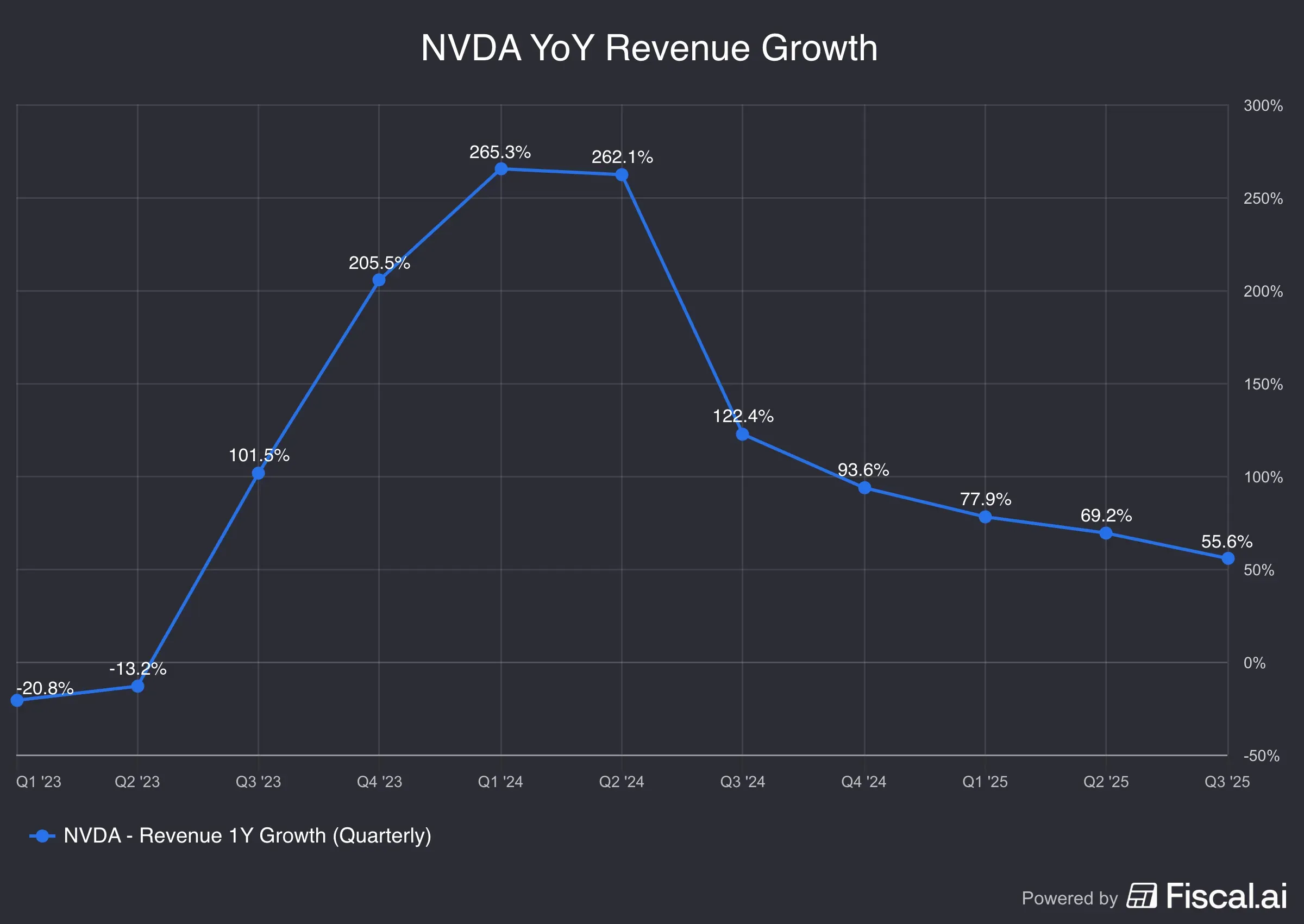

- Since the AI revolution began following OpenAI’s launch of ChatGPT, Nvidia's revenue has grown at a red-hot pace, though the pace has since moderated.

- The average price target for the stock is $234.96, implying about 30% upside from current levels.

Artificial intelligence (AI) bellwether Nvidia Corp. (NVDA) is widely anticipated to deliver a third-quarter earnings report that could be a catalyst to lift the market out of its recent rut. The rising AI skepticism has not spared Nvidia’s stock, pushing it to correction territory.

From the recent intraday high of $212.19, set on Oct. 29, the stock is down 14.5%. Given the bar is set too high for this consistent outperformer, will Jensen Huang have a trick up his sleeve to allay the mounting pessimism?

Key Nvidia Numbers Wall Street Models

For the third quarter of the fiscal year 2026, Nvidia is expected to report adjusted earnings per share (EPS) of $1.25, up from $0.81 reported a year earlier, according to Fiscal.ai. The bottom-line expectation has been revised up from $1.19 estimated 90 days ago.

The topline is expected at $55.03 billion compared to the $54 billion, +/- 2%, outlook Nvidia issued in late August when it announced its second-quarter results. The midpoint of the guidance suggests nearly 54% year-over-year (YoY) growth and an almost 16% sequential rise, compared to the 56% and 6% growth, respectively, recorded for the previous quarter.

Nvidia expects an adjusted gross margin of 73.5%+/- 50 basis points (bps) compared to 72.7% reported for the second quarter.

On the second-quarter earnings call, CFO Colette Kress said the third-quarter guidance does not assume any H20 shipments to China. However, she flagged a potential $2 billion to $5 billion augmentation to the topline if geopolitical tensions subside and China chip sales resume. In a note previewing Nvidia’s results, Cowen analysts said, given the recent political developments, they do not expect the company to include any China-related sales in the Q3 print or guidance.

Since the AI revolution began following OpenAI’s launch of ChatGPT, Nvidia's revenue has grown at a red-hot pace, though the pace has since moderated.

Source: Fiscal.ai

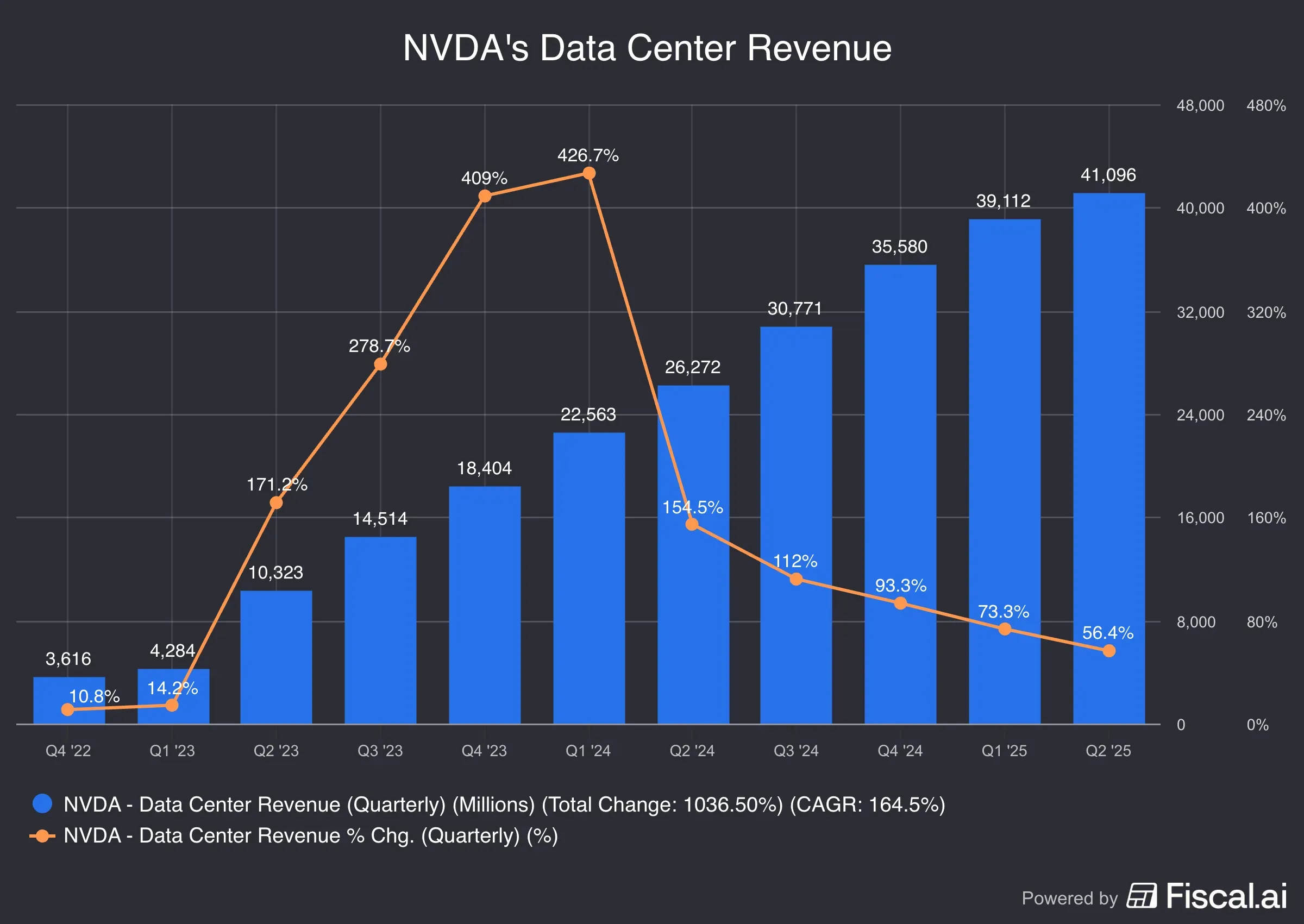

Can Data Center Deliver Another Record?

Nvidia’s data center business, which includes contributions from the sale of its advanced high-performance chips, has been breaking records with each quarter since the first quarter of 2023. The YoY growth, however, has slowed from over 400% in early 2024 to about 56% in the second quarter.

Source: Fiscal.ai

While raising Nvidia's price target to $220 from $200 last week, Morgan Stanley analyst Joseph Moore said Blackwell remained the AI chip of choice, with the upcoming Vera Rubin architecture signaling strong demand. Baird analyst Tristan Gerra echoed the view.

Moore braces for “something of a breakout quarter” as Morgan Stanley’s channel checks revealed that the company has fully resolved earlier issues with racks and demand has continued to sell.

Cowen analysts expect the transition to Blackwell Ultra processors to be progressing well, based on hyperscalers’ upward revisions to their capital expenditure (Capex) guidance.

What To Expect From Nvidia’s Earnings Call

Investors will look forward to commentary on China, a key AI market. Cowen analysts expect the management to reiterate its visibility to $500 billion of Blackwell/Rubin orders through calendar year 2026. This, according to analysts, will take Nvidia’s EPS above $9.

The firm also expects the management to highlight recent product announcements and commercial progress, such as Spectrum XGS, to demonstrate its growing portfolio and reach beyond just AI acceleration.

The fiscal fourth-quarter outlook of Wall Street analysts is at $1.43 per share for adjusted EPS and $61.75 billion for revenue.

The Nvidia Stock

Retail sentiment toward Nvidia stock shifted on the Stocktwits platform to ‘extremely bullish’ as of late Tuesday, following the day before's ‘bullish’ mood. The message volume remained ‘high.’

An ongoing Stocktwits poll showed that about three-fourths of the 36,000 respondents expected the company to beat earnings estimates.

A bullish watcher, though bracing for a slight drop in the stock even if earnings surpass expectations, viewed the company as a savior for the broader market.

Another user said they would prefer to buy call options expiring Dec. 5, instead of “playing poker this coming weekend.”

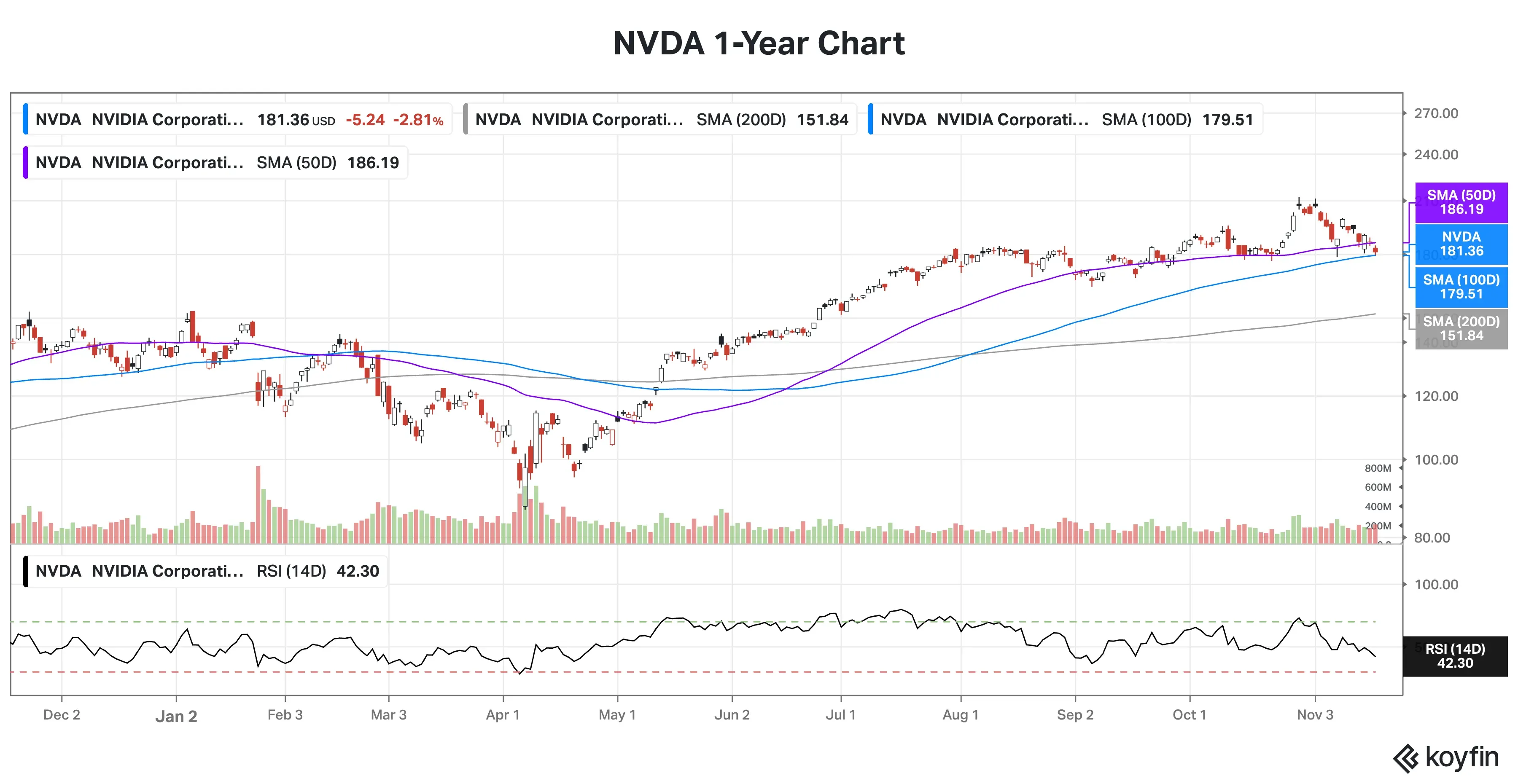

Nvidia’s technical chart shows the stock is currently ensconced between its 50- and 100-day simple moving averages (SMA). The underlying trend is bullish, as the key shorter-term moving averages trade above their shorter-term counterparts. The 14-day relative strength index (RSI) suggests the stock trades slightly below the neutral zone but isn’t yet oversold.

Source: Koyfin

Source: Koyfin

The recent market pullback has taken the stock toward a consolidation area seen in mid-October. In the eventuality of an adverse reaction to earnings, the stock could backfill a gap from late September and break below the $170 level.

Last earnings, the stock gained 3.5% in the five sessions preceding the report, but this time around it has lost 6.4%. It, however, retreated 5.5% following the Q2 report.

Nvidia’s stock has traded in a 52-week range of $86.62 to $212.19, and has gained 35% YTD. According to Koyfin, the average price target for the stock is $234.96, suggesting about 30% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)