Advertisement|Remove ads.

Nvidia Stock Rises As Argus Calls Its Products Unmatched, Evercore Adds It To ‘Tactical Outperform’ List: Retail’s Divided

Shares of Nvidia Corp. (NVDA) gained more than 3% during Monday’s mid-day trade after analysts at multiple brokerages posted a bullish outlook for the stock.

According to TheFly, analysts at Argus pointed to Nvidia’s lead over rivals like Advanced Micro Devices Inc. (AMD), Intel Corp. (INTC), and custom silicon from big technology companies like Alphabet Inc.’s Google (GOOG), Amazon.com Inc. (AMZN), Meta Platforms Inc. (META), among others.

The brokerage noted that Nvidia’s AI chips are unmatched by competitors. The Jensen Huang-led company capitalized on its first-mover advantage to become the primary provider to major artificial intelligence (AI) and cloud service providers.

Argus analyst Jim Kelleher reiterated a ‘Buy’ rating on the Nvidia stock with a price target of $175, implying an upside of over 30% from current levels.

He underscored Nvidia’s “multi-generation” lead in graphics processing unit (GPU) computing technology and its integration with its software and hardware solutions, making for an unmatched offering.

Analysts at Evercore ISI also weighed in on the Nvidia stock, adding it to their ‘Tactical Outperform’ list.

The brokerage performed channel checks to understand DeepSeek's impact on AI demand, a possible shift away from GPUs to application-specific integrated circuits (ASIC), and concerns around Blackwell delays.

After its checks, Evercore reiterated its long-term bull thesis for Nvidia and maintained its ‘Outperform’ rating with a price target of $190.

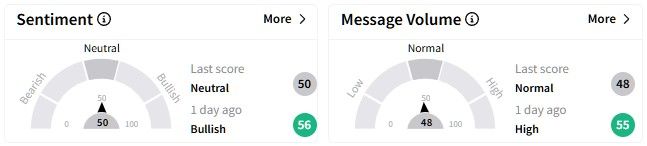

Retail sentiment on Stocktwits around Nvidia was not as bullish – it hovered in the ‘neutral’ (50/100) territory, declining slightly from ‘bullish’ (56/100) a day ago.

However, one user quipped that the Nvidia stock is back to doing its usual thing.

Nvidia’s stock has gained a little over 23% over the past six months, in contrast to its one-year performance when it gained nearly 86%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)