Advertisement|Remove ads.

Cloudflare Stock Surges To Over 3-Year Highs Amid Multiple Price Target Hikes Post Q4 Earnings: Retail Stays Extremely Bullish

Shares of Cloudflare Inc. (NET) surged nearly 5% during morning trade on Monday, rising to an over 38-month high as multiple price targets poured in after the company’s fourth-quarter earnings.

According to The Fly, analysts at Susquehanna and Mizuho increased their price targets for the Cloudflare stock while reiterating their ‘Neutral’ rating.

Susquehanna’s price target for Cloudflare has been increased to $170 from $95, while Mizuho’s price target is $160, up from $130.

At the time of writing, Cloudflare’s stock was trading at over $175, well above the new price targets of both brokerages.

According to data from FinChat, the average price target for Cloudflare as of Feb. 7 was $140.77.

This comes after Cloudflare beat analyst estimates with its fourth-quarter earnings.

The content delivery service provider posted an earnings per share (EPS) of $0.19, ahead of consensus estimates of $0.18. Its revenue of $459.9 million was also better than the expected $452.04 million.

Susquehanna analysts focused on Cloudflare management’s optimistic commentary for fiscal year 2025, which focused on its ability to win large customers.

Despite the price target hike, Mizuho analysts cautioned that Cloudflare stock carries a relatively high valuation.

FinChat data shows Cloudflare’s forward price-to-earnings ratio stood at 203.9, while that of its industry peers like GoDaddy Inc. stands at 33.6, Mongodb Inc. at 90, and Akamai Technologies Inc. at 15.2.

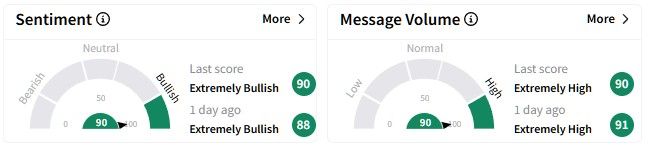

On Stocktwits, retail sentiment around the Cloudflare stock remained in the ‘extremely bullish’ (90/100) territory, increasing slightly from a day ago. Message volume remained at ‘extremely high’ levels at the time of writing.

One user on the platform wondered if they should book profits after Cloudflare stock’s recent surge.

Cloudflare’s stock has been on a tear recently, more than doubling over the past six months, with gains of over 127%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Strategy Stock Edges Up On Resuming BTC Purchases Despite Wall Street’s Price Cuts: Retail’s Worried

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)