Advertisement|Remove ads.

Nvidia Stock Rises Pre-Market As Asia AI Investment Plans Boost Retail Sentiment

Nvidia Corp. ($NVDA) shares closed Monday’s session at a fresh record as they settled above the $140 mark for the first time ever on a split-adjusted basis.

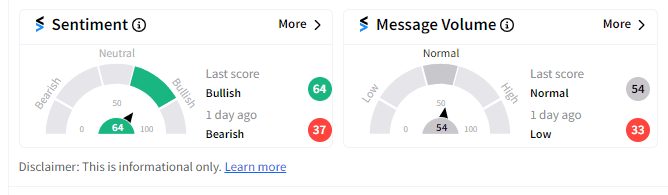

Retail sentiment on Stocktwits, which was bearish a day ago, reversed course in premarket trading amid a couple of reports regarding the Jensen Huang-led company’s Asia investment plans.

The Santa Clara, California-based chipmaker is eyeing development of an AI chip exclusively for the Indian market, tapping into the domestic design talent, local news outlet Economic Times reported, citing people familiar with the matter.

India’s Union Minister for electronics and IT reportedly confirmed the news to the publication. “Yes, we are discussing with Nvidia the development of an AI chip; discussions are at a preliminary stage,” he reportedly said.

Separately. Thailand’s Commerce Minister Pichai Naripthaphan said Nvidia will announce investments in Thailand during Huang’s visit to the Southeast Asian nation this December, Bloomberg reported. “The investment by Nvidia could lead to more funding ‘with related clusters following suit,’” the minister reportedly told Bloomberg.

On Stocktwits, NVDA’s sentiment score flipped into ‘bullish’ (64/100) territory from ‘bearish’ a day ago, as of 8:30 a.m. ET on Tuesday

The retail crowd anticipates more gains for Nvidia and sees the stock scaling the $150 threshold in the near term.

Some also see the muted performance in the premarket session as a good omen for the stock.

Nvidia ended Monday’s session with a market-cap of $3.525 trillion, and is on the cusp of toppling Apple, Inc. ($AAPL) as the most valued global corporation, with a deficit of only $63 billion. A per-share gain of $2.6 could take it past Apple, provided Apple trades flat or falls in Tuesday’s session.

In premarket trading, Nvidia was up 0.27% at $144.10. The iShares Semiconductor ETF ($SOXX) in which Nvidia is the top holding eased 0.62% to $227.50, and the VanEck Semiconductor ETF ($SMH) fell 0.32% to $252.03.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)