Advertisement|Remove ads.

NVDA, TSLA, CCL: Retail Pulse On Most Active S&P 500 Stocks Premarket

The S&P 500 yesterday enjoyed its best session since June 5, buoyed by a rebound in tech shares after the index’s worst weekly loss since April, according to MSNBC. Among the top active stocks by trading volume pre market on Tuesday were Nvidia Corp (NVDA), Tesla, Inc. (TSLA), Carnival Corp (CCL), AT&T (T), and AMD. Retail investors appear bullish on all but one, per Stocktwits data.

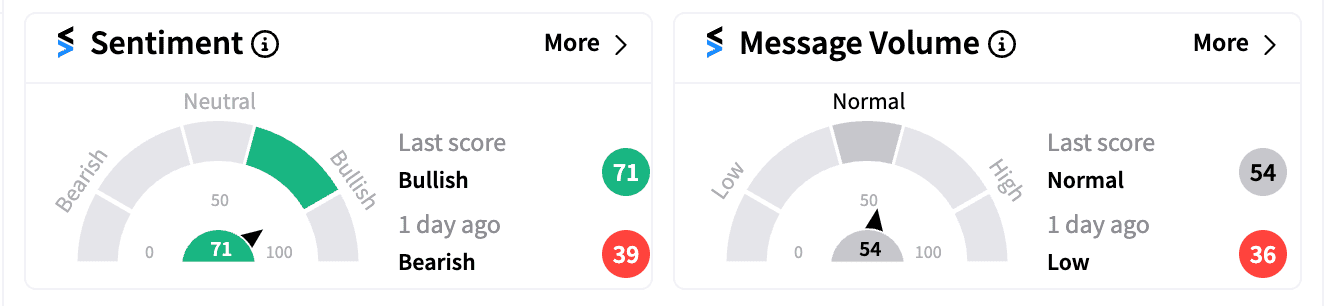

Nvidia Corp (NVDA): Down 0.45% at $122.98

Retail Sentiment: Flipped to bullish (71/100) from bearish (39/100) a day ago.

Key Drivers: Nvidia led the S&P 500 rebound in the previous session, closing 4.7% higher. This boost followed news of a new high-performance AI processor, “B20,” for the Chinese market amid U.S. trade restrictions. Piper Sandler raised its one-year price target from $120 to $140, citing favorable business trends and the launch of Nvidia’s new Blackwell chip platform. Loop Capital also reiterated its buy rating, increasing its target from $120 to $175, predicting significantly higher data center revenue than Wall Street expects. Stocktwits posts suggest optimism, with popular bullish sentiments indicating a potential surge to $130.

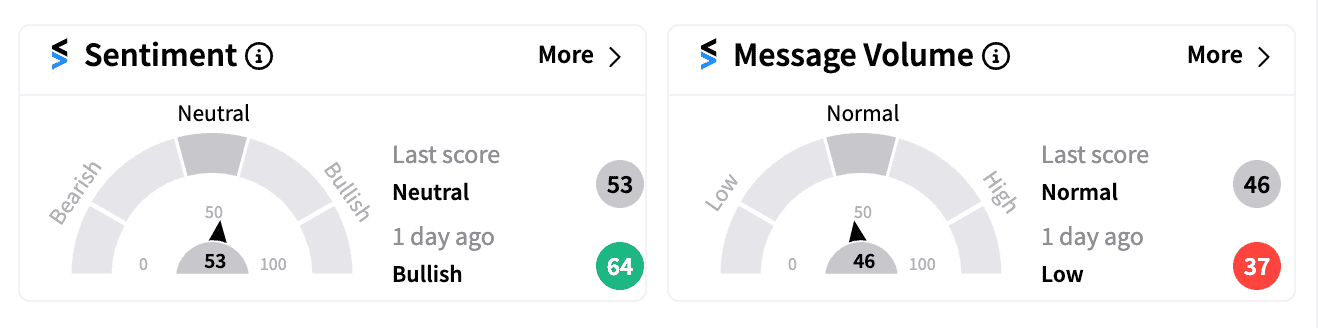

Tesla, Inc. (TSLA): Up nearly 1% at $254.00

Retail Sentiment: Neutral (53/100) despite a 5% surge in the previous session.

Key Drivers: Investor caution ahead of second-quarter earnings after a recent rally driven by better-than-expected quarterly delivery numbers. Tesla has missed EPS estimates for the past three quarters, battling thinning margins and a slowdown in EV demand in a high-inflation environment. Analysts expect an EPS of $0.61 for Q2. Stocktwits user ‘microm’ noted a “bull pennant” formation and suggested earnings could catalyze a breakthrough. However, Cathie Wood’s Ark Invest sold 14,859 shares, adding selling pressure despite Wood’s optimistic long-term view.

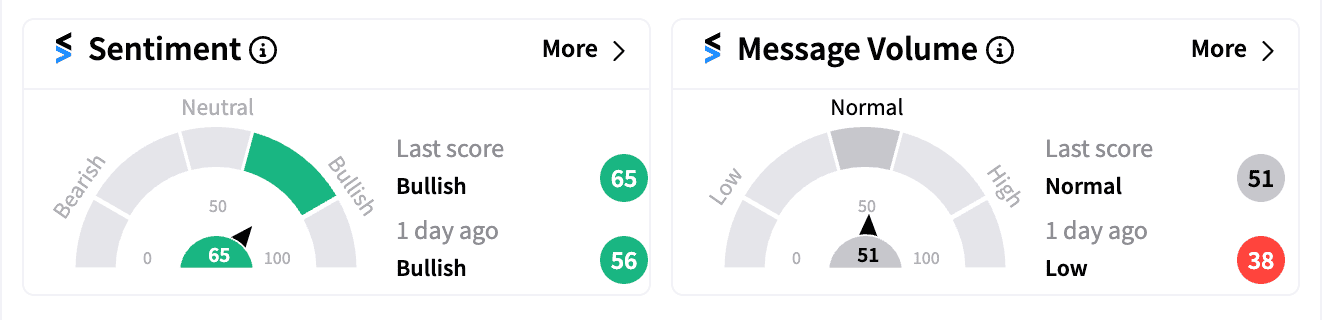

Carnival Corp (CCL): Up 0.16% at $18.45 premarket

Retail Sentiment: More bullish (65/100) compared to the previous day.

Key Drivers: Shares have risen over 3.30% since strong quarterly results in June and optimistic guidance. Analysts, including Goldman Sachs and Stifel, have praised the company’s surging booking volumes. The consumer discretionary sector, including CCL, received a boost from a rise in June retail sales, indicating continued consumer spending. With inflation showing signs of easing and increased bets on rate cuts in September, CCL might see further gains.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)