Advertisement|Remove ads.

NXTT Stock Surged 60% Today – What’s The Bitcoin Angle?

Summary:

· The MoU proposes two options: buying up to 10,000 Bitcoin at a fixed price of $84,000 each or acquiring Global Nexgen based on the value of its Bitcoin holdings at the locked price.

· NXTT stock is on track to close in the green for the first time in 14 sessions, declining nearly 61% during the period.

· As of last close, the stock had gained in only two sessions this month.

Shares of Next Technology Holding Inc. (NXTT) surged more than 60% on Friday, after its unit signed a deal for a potential Bitcoin transaction.

NXTT stock is on track to close in the green for the first time in 14 sessions, declining nearly 61% during the period. As of last close, the stock had gained in only two of this month's sessions.

Bitcoin Deal

According to an SEC filing on Wednesday, Next Technology’s unit, Next Investment Group, signed a non-binding memorandum of understanding (MoU) with Global Nexgen to explore a potential Bitcoin-related deal.

The MoU outlines two possible paths: the purchase of up to 10,000 Bitcoin at a fixed price of $84,000 per coin, or the acquisition of Global Nexgen in full at a purchase price equal to the total BTC held by Global Nexgen multiplied by the fixed price.

Although the agreement is non-binding, both parties have committed to a 90-day exclusivity period to negotiate a definitive deal.

How Did Stocktwits Users React?

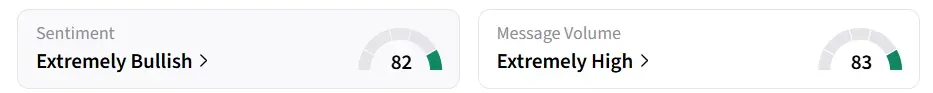

Retail sentiment on Stocktwits shifted to ‘extremely bullish’ from ‘neutral’ a day earlier, accompanied by ‘extremely high’ volumes. NXTT was also among the top trending tickers on the platform.

One user sees $12 as a key resistance level.

Last month, Next Technology posted a third-quarter loss of nearly $17 million, compared with a profit of around $1.4 million a year earlier.

On September 16, the company completed a 200-for-1 reverse stock split, combining every 200 existing shares into a single share. As a result, the total number of outstanding shares decreased to about 2.87 million from roughly 566.3 million.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HPE_office_with_logo_resized_c15b2ba0d3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_market_fall_generic_jpg_f7dffafa95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201937_jpg_67aaff68c1.webp)