Advertisement|Remove ads.

Nykaa Drops After Major Block Deal: SEBI RA Flags Overvaluation Risks

Shares of FSN E-commerce Ventures (Nykaa) fell over 4% on Thursday, after a large block deal saw nearly six crore shares changing hands. That translates to approximately 2.3% of the company’s total equity, valued at ₹1,210 crore.

Reports suggest that early investors Harindarpal Singh Banga and Indra Banga halved their holdings from nearly 5% to around 2–2.5% through this block deal.

Fundamentally, SEBI-registered analyst Mayank Singh Chandel highlighted that Nykaa appeared expensive, with a price-to-earnings (P/E) ratio of 879. The stock is trading at 44.6 times its book value. He also noted that Nykaa’s capital efficiency metrics, such as return on equity (RoE) and return on capital employed (RoCE), are weak, with little improvement in operational efficiency.

Additionally, foreign institutional investors (FIIs) and public holdings have decreased in the past few quarters, indicating a decline in investor confidence.

On the technical charts, Chandel observed that the shares are in a downtrend but have been forming a base with a slightly bullish bias. The stock is currently trading above the 200-day Exponential Moving Average (EMA).

He advises that if Nykaa shares break their resistance level of ₹225–260 and sustain above it, along with improved fundamentals, then it could trigger a strong uptrend. However, given the weak fundamentals, Chandel advised a cautious approach, despite the technical strength on the charts.

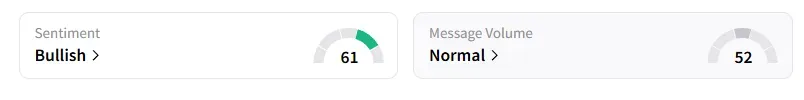

Data on Stocktwits shows that retail sentiment remained ‘bullish’ on this counter.

Nykaa shares have gained 23% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)