Advertisement|Remove ads.

Diwali 2025 Pick: Nykaa Stock May Hit ₹315 Soon, Says Analyst Priyank Sharma

Nykaa shares have extended the bullish momentum, rising over 10% in the past month, and are on track to clock their biggest yearly jump.

However, one must note that Nykaa has mostly traded below its listing price for the past three years. In the last two years, the price has shown a strong recovery, gaining nearly 132% and currently trading around ₹265 (still below its listing at ₹336.35 in 2021)

SEBI-registered analyst Priyank Sharma highlighted that this rally shifted the structure upward. In 2025, the stock successfully broke the previous year’s high of ₹230, confirming an uptrend. Looking ahead, if the momentum continues, he expects the price may test ₹315 levels, which will be a key zone to determine whether it can move towards creating a new all-time high above ₹429.

Sharma recommended Nykaa shares for ladder buying up to ₹215 from the current market price, with target prices set at ₹315, ₹395, ₹430, and open-ended beyond that. He advised holding a stop loss at ₹200 on a weekly closing basis with an investment duration of three to six months for short-term targets and over 15 months for a potential new high. It is Sharma's Diwali 2025 pick.

Challenges & Risks

Sharma noted that the beauty and fashion sector is highly competitive, and heavy spending on marketing and discounts can impact profitability. Also, economic slowdowns can affect demand.

Since Nykaa already trades at high valuations, he cautioned that any decline in growth, execution inefficiencies, or margin pressures could create valuation risk.

Triggers To Watch

Margin expansion remains a key driver, according to Sharma. If Nykaa continues to improve its operating and EBITDA margins, he believes that the current valuation premium could be justified.

He also advised that monitoring growth in non-beauty verticals such as fashion and home products can provide diversification and reduce dependency on the core beauty segment.

What Is The Retail Mood?

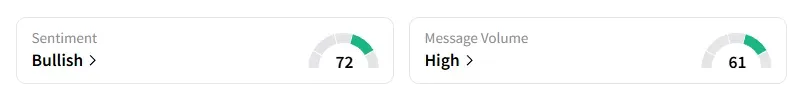

Data on Stocktwits showed retail sentiment has been ‘bullish’ for a week amid ‘high’ message volumes after the company shared a strong business update for Q2.

Nykaa shares have surged over 60% year-to-date (YTD).

Disclaimer: The views and opinions expressed are those of the SEBI-registered analyst/advisor mentioned in the article, and are not endorsed by Stocktwits. This is not investment advice. Please do your own research or consult a financial advisor.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es6_jpg_b768981c5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228901180_jpg_0c2cc7dc28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)