Advertisement|Remove ads.

Lululemon Stock Soars After-Hours On Blowout Q3, Upbeat Full-Year Forecast And Surprise CEO Exit

- Revenue and EPS beat estimates, supported by strong international growth.

- Full-year earnings outlook was raised despite margin pressure.

- CEO Calvin McDonald will step down in early 2026 as a successor search begins.

Lululemon Athletica (LULU) shares rose 11% in after-hours trading on Thursday after the retailer posted third-quarter results that exceeded Wall Street expectations and raised its full-year earnings forecast.

Q3 Review

Lululemon reported $2.6 billion in net revenue for the quarter, marking a 7% increase that topped analyst expectations of about $2.48 billion. Diluted earnings per share (EPS) came in at $2.59, beating the $2.21 consensus, though down from $2.87 a year earlier.

Comparable sales edged up 1%, or 2% on a constant-dollar basis. Performance varied sharply by region: revenue in the Americas slipped 2%, while international markets continued to accelerate, rising 33%.

Margins softened, with gross margin declining 290 basis points to 55.6%, and operating income falling 11% to $435.9 million. The company ended the period with 796 stores, having opened 12 net new locations.

CEO Calvin McDonald said Lululemon is “beginning to make progress” on improving its U.S. business and noted that early holiday trends have been encouraging.

Outlook Raised Despite Tariff-Related Cost Pressure

Lululemon now expects full-year EPS of $12.92–$13.02, above consensus of $12.85, and revenue of $10.96–$11.05 billion, putting the company on track to generate about $11 billion in annual sales this fiscal year.

For the fourth quarter (Q4), the company guided to EPS of $4.66–$4.76, below estimates of $4.93, and revenue of $3.5–$3.585 billion.

The full-year outlook incorporates an estimated $210 million hit to operating income tied to higher U.S. tariffs and removal of the de minimis exemption.

CEO Succession Plan

Separately, Lululemon said that CEO Calvin McDonald will step down on Jan. 31, 2026, after seven years leading the company. He will remain as a senior advisor through March 31, 2026. The board has launched a CEO search with an external firm.

Board Chair Marti Morfitt has been appointed Executive Chair, effective immediately. CFO Meghan Frank and Chief Commercial Officer Andre Maestrini will serve as interim co-CEOs during the transition.

Lululemon credited McDonald with more than tripling annual revenue, expanding into over 30 geographies, and growing China into the company’s second-largest market.

How Did Stocktwits Users React?

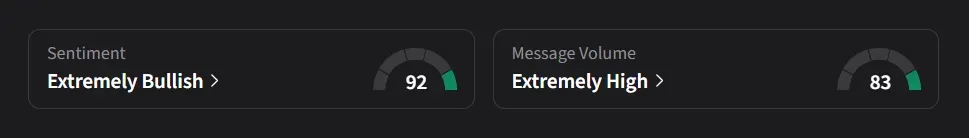

On Stocktwits, retail sentiment for Lululemon was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “super undervalued lol bought a ton already and going to buy more.”

Another user said the stock “is ripping higher off the lows on solid earnings and a double beat. Buyers stepped in exactly where they were supposed to. Lots of happy members this evening.”

Lululemon’s stock has declined 51% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)