Advertisement|Remove ads.

Ocugen Stock Rises On Better-Than-Feared Q1 Loss: Retail Turns Bullish

Shares of Ocugen, Inc. (OCGN) rose 3% on Friday morning after the company reported a better-than-feared first-quarter (Q1) loss.

The biotechnology company reported a revenue of $1.5 million, up from $1 million in the corresponding quarter of 2024.

Loss per share came in at $0.05, unchanged from the corresponding quarter of 2024, and better than the estimated loss of $0.06 per share.

The company, which is developing gene therapies for blindness diseases, ended the quarter with cash and restricted cash totaling $38.1 million, compared to $58.8 million as of Dec. 31, 2024. It expects this will provide runway into the first quarter of 2026.

CEO Shankar Musunuri said that the company is “on track” to meet its goal of submitting applications to the U.S. Food and Drug Administration (FDA) requesting approval for the distribution of three of its products in the next three years.

“We remain steadfast in our mission to provide a one-time therapy for life to address considerable unmet medical needs that exist for millions of patients facing the terrifying prospect of losing their vision," he said.

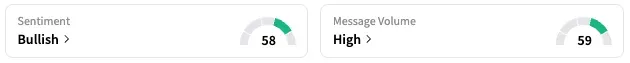

On Stocktwits, retail sentiment around Ocugen jumped from ‘neutral’ to ‘bullish’ territory over the past 24 hours while message volume stayed at high levels.

A Stocktwits user expressed optimism for the stock, citing the three upcoming FDA applications.

Another noted that the low cash reserve is expected in a company not selling products yet.

OCGN stock is down by 21% this year and 57% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_applovin_OG_jpg_12b141cd06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)