Advertisement|Remove ads.

Top Nifty IT Gainer: OFSS Soars On Parent Company’s Blockbuster Cloud Guidance

Oracle Financial Services Software (OFSS) shares surged 10% on Wednesday, following aggressive commentary on the cloud business from its parent company, Oracle Corporation.

At the time of writing, OFSS stock was up nearly 800 points at ₹9,204. It was the top gainer on the Nifty IT index, and among the top trending stocks on Stocktwits.

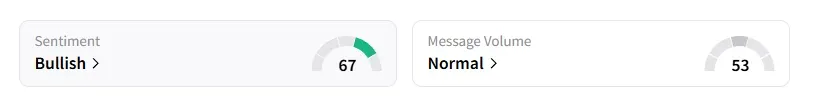

Data shows that retail sentiment shifted to ‘bullish’ earlier this week.

Ambitious Outlook

Oracle announced a massive jump in bookings to $455 billion, driven by large new deals with companies such as OpenAI, TikTok, and Nvidia. Oracle CEO Safra Catz said the company signed four multi-billion-dollar contracts with three customers in the first quarter.

The company also projected cloud infrastructure revenue growth of 77% this year and nearly eightfold expansion by 2030, beating Wall Street expectations and causing Oracle’s stock to rally 30% in after-hours trading — its biggest single-day gain since 1999.

Meanwhile, the company has also reportedly announced layoffs in its Indian offices, impacting employees across verticals.

Broad Based Buying In IT

Technology shares have outperformed other indices for the second straight session after US President Donald Trump and Indian Prime Minister Narendra Modi said they look forward to resolving the trade negotiations between the two nations. Additionally, the rising bets on a US Federal Reserve rate cut in its meeting next week support the bullish sentiment.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)