Advertisement|Remove ads.

Olive Garden Parent Darden's Stock Soars After Upbeat Q4 Results, $1B Buyback: Retail Spirits Stay High

Strong results, along with a buyback and divestiture plan from Darden Restaurants (DRI), lifted its shares to an all-time high and boosted sentiment among retail investors.

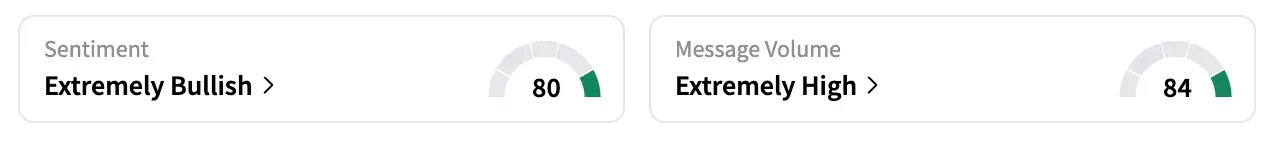

Shares rose 1.4% to $203.14 on Friday, while retail sentiment on Stocktwits shifted to 'extremely bullish' from 'neutral' the previous week.

A user said, "with (the) Uber partnership sales will go lot higher going forward" and the stock could rise to $260 in the near term.

Darden operates several eateries, including Olive Garden, LongHorn Steakhouse, and Cheddar's Scratch Kitchen, and has about 2,000 outlets in the U.S.

The chain reported that revenue in the fourth quarter increased 11% to $3.27 billion, and same-store sales rose 4.6%, driven by strong traffic to Olive Garden and LongHorn Steakhouse. Both figures were above analysts' estimates.

Adjusted earnings of $2.98 were also above expectations.

Darden announced that its board had approved a plan to buy back shares up to $1 billion, with no expiration date. "Our long-term framework calls for 10-15% Total Shareholder Return over time," said Darden CFO Raj Vennam.

The company is also exploring options, including a sale, for its Bahama Breeze brand. The outcome would not materially affect the company's financial results, it said.

Darden shares are up 21% year-to-date.

Following the results and the corporate announcements, Barclays raised the price target on the company's shares to $255 from $235. The results eased growth concerns for itself and the broader restaurant industry, the investment firm said in a note on The Fly.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)