Advertisement|Remove ads.

Ollie’s Bargain Outlet Stock In Focus After Acquisition Of 40 Big Lots Store Leases: Retail Sentiment Brightens

Shares of closeout store Ollie’s Bargain Outlet Holdings Inc. (Olli) rose 0.3% in after-hours trading on Thursday after the company announced the acquisition of 40 former Big Lots store leases from Gordon Brothers, lifting retail sentiment.

The acquisition of the additional store leases is subject to final bankruptcy court approval and customary closing conditions.

With these 40 additional Big Lots locations, Ollie’s has acquired a total of 63 former Big Lots store leases to date.

“Everything about these stores lines up well with our business and growth strategy. These locations are the right size, come with favorable lease terms, are located in existing and adjacent trade areas, and have long serviced value-conscious consumers,” said Ollie’s newly appointed president and CEO Eric van der Valk.

The company plans to boost new store openings in 2025 above its 10% annual growth target and open about 75 “units,” Van der Valk added.

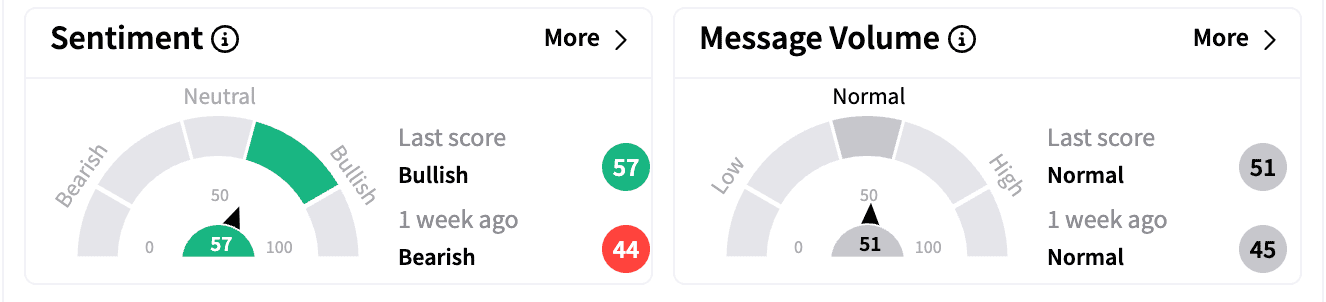

Sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ a week ago. Message volume climbed in the ‘normal’ zone.

Earlier this month, the company received a downgrade from Jefferies, which cut the rating to ‘Hold’ from ‘Buy’ with a price target of $111, reduced from $125, The Fly reported.

According to the report, the research firm says "storm is brewing" in the U.S. consumer discretionary sector as industry inventories are rising for the first time in two years and are expected to exceed sales growth.

Ollie’s currently operates 568 stores in 31 states.

Ollie’s Bargain stock is down 9.7% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2261643084_jpg_6360b6a821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Quantum_Computing_jpg_8d3aa87e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_capitol_building_OG_jpg_388637a98c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)