Advertisement|Remove ads.

Omada Health Stock Jumps Into Retail Focus As Wall Street Lifts Price Targets After ‘Beat And Raise’ Quarter, GLP-1 Push

- Morgan Stanley, Evercore ISI, and Barclays raised price targets to between $28–$32, citing Omada’s revenue growth and its first positive adjusted EBITDA.

- The company plans to integrate GLP-1 prescribing and medication management into its weight-health program, expanding its digital-care platform.

- Retail traders highlighted the company’s strong balance sheet, high gross margins, and operating leverage as signs of growth potential.

Retail chatter on Omada Health surged over the weekend after several brokerages raised price targets following stronger-than-expected third-quarter (Q3) results and the company’s new GLP-1 prescribing initiative for its weight-health program.

Analyst Upgrades

Morgan Stanley raised its price target on Omada Health to $32 from $30 and kept an ‘Overweight’ rating, citing 49% year-over-year revenue growth, an 11% beat versus consensus, and the company’s first quarter of positive adjusted EBITDA. The firm said momentum continues and highlighted the addition of GLP-1 prescribing to Omada’s offering as a key development.

Evercore ISI increased its price target to $28 from $27 and maintained an ‘Outperform’ rating, noting that Q3 revenue and EBITDA beat expectations and full-year 2025 guidance was raised.

Barclays lifted its price target to $29 from $28 and reiterated an ‘Overweight’ rating, describing Omada’s results as “another beat and raise quarter.”

Q3 Review

Omada reported revenue of $68 million, ahead of consensus estimates of $61.2 million. Total members rose 53% to 831,000, while the company’s net loss narrowed to $3 million from $9 million a year earlier. Omada achieved its first positive adjusted EBITDA of $2 million, compared with a $5 million loss in the prior-year period.

Gross margin improved to 66%, and cash and cash equivalents totaled $199 million at quarter-end.

CEO Sean Duffy said the results demonstrate “the strength of Omada’s multi-product platform” as the company deepens its innovation in GLP-1 care options and AI tools aimed at delivering “sustainable outcomes” and “cost savings” for customers.

GLP-1 Expansion And Product Updates

The company announced plans to integrate prescribing and medication management for anti-obesity medications, including GLP-1s, into its weight-health program.

Omada also launched Meal Map, an AI-driven nutrition platform that prioritizes nutrient quality over calorie tracking, and published results from its 30th peer-reviewed research study, which showed savings generated from its Joint & Muscle Health program. Additional results showed that members largely sustained their weight a year after stopping GLP-1 treatment.

Financial Outlook

Omada raised its FY25 revenue guidance to $251.5 million-$254.5 million, up from a prior range of $235 million–$241 million, and now expects adjusted EBITDA between breakeven and a $2 million loss, compared with earlier guidance for a $9 million–$5 million loss.

Stocktwits Traders Say Omada’s GLP-1 Plan Shows Real Execution

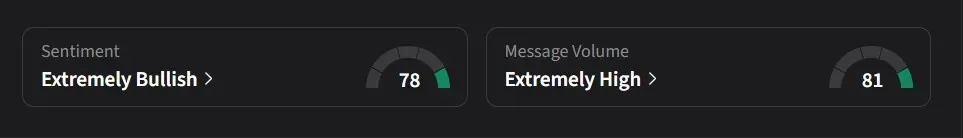

On Stocktwits, retail sentiment for Omada was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said some companies “just mention GLP-1 to garner headlines” without clear execution plans, but noted that Omada Health already has case studies, proof-of-concept, and “the balance sheet to boost this up.” They added that the business model is proven and now depends on strong marketing to capture the opportunity.

Another user said the company’s financials “prove it,” pointing to high gross margins, positive adjusted EBITDA, and improved cash flow as signs of operating leverage and a “stellar management team.”

Omada Health’s stock has declined 12% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)