Advertisement|Remove ads.

ONEOK Stock Gains After The Bell Following Q4 Profit Rise: Retail Mood Brightens

ONEOK (OKE) stock edged higher in aftermarket trade on Monday after it reported a 34% rise in quarterly profit.

The pipeline operator posted a net income of $923 million, or $1.57 per share, compared with $688 million, or $1.18 per share, in the year-ago quarter.

Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) rose to $2.17 billion, compared with $1.51 billion in the year-ago quarter. Analysts, on average, expected it to post EBITDA of $1.99 billion.

The midstream company’s Adjusted EBITDA rose across all segments. Its natural gas pipelines unit’s earnings more than tripled to $417 million and the refined products and crude segment’s earnings rose 42% to $603 million.

Its crude oil shipment volumes rose 3% sequentially to 839,000 barrels per day (bpd), while refined products shipment volumes fell to 1.52 bpd from 1.58 bpd last year.

However, the company’s average tariff rate in the refined products segment rose by 5% compared to the previous quarter.

The company forecasted 2025 earnings in the range of $4.97 to $5.77 per share, driven by increased production.

"We expect continued volume growth across our systems from completed projects and continued execution on synergies from recent acquisitions, which will provide additional opportunities across our footprint, including our expanded presence in the Permian Basin and Gulf Coast region," said CEO Pierce Norton.

Last year, the company agreed to buy the remaining units of EnLink Midstream for $4.3 billion and Medallion Midstream for $2.6 billion.

ONEOK projected 2025 capital expenditures between $2.8 billion to $3.2 billion.

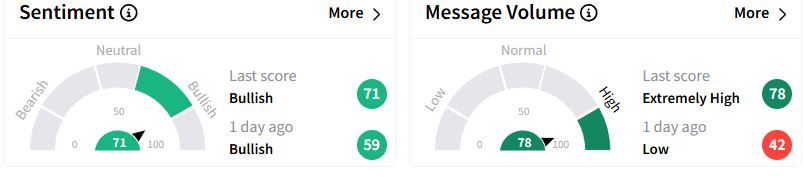

Retail sentiment on Stocktwits moved higher in the ‘bullish’ (71/100) territory than a day ago, while retail chatter rose to ‘extremely high.’

One user wondered whether the stock could hit $105 following the earnings report.

Over the past year, ONEOK stock has gained 34.8% on optimism around demand growth from liquefied natural gas projects and artificial intelligence data centers.

Also See: Civitas Resources Stock Falls Aftermarket On Q4 Profit Miss, Retail Shrugs It Off

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)