Advertisement|Remove ads.

Civitas Resources Stock Falls Aftermarket On Q4 Profit Miss, Retail Shrugs It Off

Civitas Resources (CIVI) stock fell 4.7% in extended trade on Monday after the company’s fourth-quarter earnings fell short of Wall Street’s estimates.

According to FinChat data, the oil and gas producer reported adjusted net earnings of $1.78 per share for the last quarter of 2024, while analysts, on average, expected the company to report $1.99 per share.

The company’s quarterly revenue of $1.29 billion also fell marginally short of Wall Street's estimates.

Its net income fell to $151.1 million, or $1.57 per share, compared with $302.9 million, or $3.23 per share, in the year-ago quarter.

The energy firm’s average sales volumes per day rose 1% to 352,000 barrels of oil equivalent per day (boe/d), aided by more substantial output from DJ Bain following a high number of third-quarter turn-in-lines.

The rise in sales volumes offset higher cash operating costs, primarily in its Permian Basin assets, due to winterization efforts and higher workover and maintenance activities.

“We are maintaining a disciplined posture in 2025 in the face of market volatility,” CEO Chris Doyle said before adding that the company would focus on lowering its debt.

It set a target of reducing year-end 2025 net debt below $4.5 billion. It had a net debt of $4.49 billion as of Dec. 31.

Civitas also said it would lay off about 10% of its workforce across all levels of the organization.

The company added 19,000 net acres in the Permian basin through a $300 million bolt-on transaction.

The Denver-based company expects 2025 capital investments to fall by 5% to $1.8 to $1.9 billion and oil production between 150,000 and 155,000 barrels per day.

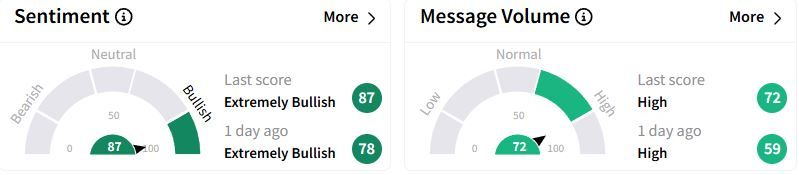

Retail sentiment on Stocktwits moved higher in the ‘extremely bullish’ (87/100) territory than the previous day, while retail chatter remained ‘high.’

One user said that the future outlook looks positive and 2025 should be a ‘great year’ for the stock.

Over the past year, Civitas shares have fallen 17.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236894865_jpg_fc1259ad29.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215332175_jpg_11a3fe7b09.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)