Advertisement|Remove ads.

Opendoor Draws Retail Buzz Ahead Of Warrants Issue: Retail Investors Speculate Robinhood Tie-Up

- OPEN was trending on Stocktwits early Tuesday, ahead of the cutoff for issuing special warrants.

- Retail watchers are expecting a short squeeze, with some speculating that the company would announce a partnership with Robinhood.

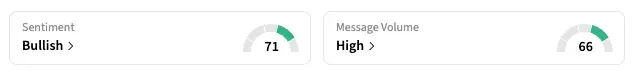

- Stocktwits sentiment for OPEN dipped to ‘bullish,’ after a three-session share drop.

Opendoor Technologies, Inc. drew fresh buzz on Stocktwits early Tuesday, ahead of the cutoff time for issuing its special ‘KAZ’ warrants.

The real estate tech company will issue warrants to shareholders of record as of 5 pm ET on Tuesday. Holders of lots of 30 Opendoor shares will get one warrant per lot. The warrants are split into three series — K, A, and Z — each with a different exercise price: $9 (Series K), $13 (Series A), and $17 (Series Z).

Retail’s Buzzing With Speculations

“Those with a casino mentality should not own OPEN… Accumulate and hold, buy the dips, sit on the shares and warrants for a while,” a bullish user said, summarizing the market uncertainty about how the issue will affect the share price.

Users on X and Stocktwits also noticed that Opendoor’s stock was unavailable for trading overnight on one platform, fueling speculation. “I think it has to do with an announcement coming in the morning about a partnership with HOOD,” the Stocktwits member said.

“Many thought a partnership would be announced during the last quarterly on the RobinHood platform. A GameStop-style squeeze started by a partnership announcement would be epic,” said another user.

Stock Yet To Break Out

Notably, OPEN stock has fallen for three straight sessions, losing more than 16% of its value. The warrants issue (distribution will happen on Friday) is at the top of the list of considerations for retail investors in a week packed with signals — including Opendoor’s underwhelming quarterly results and fresh insider share purchases.

On Stoctwits, the retail sentiment for OPEN dropped to ‘bullish’ as of early Tuesday, from ‘bearish’ the previous day, while the 24-hour message volume surged 640%.

As of the last close, the stock is up 390% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_a4b797d3d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)