Advertisement|Remove ads.

Opendoor’s Bold AI Rebrand After Weak Q3 Falls Flat: Stock Plunges Nearly 15% After-Hours, Retail Bulls Unfazed

- Opendoor reported a 34% decline in third-quarter revenue and a wider net loss, and forecast sales to decline quarter over quarter in Q4.

- Shares dropped nearly 15% in the after-market session on Thursday.

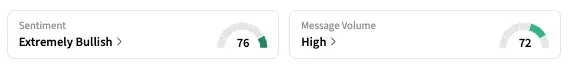

- Stocktwits sentiment for OPEN, however, flipped to ‘extremely bullish’ from ‘bearish.’

Opendoor Technologies, Inc.’s stock plunged 14.8% in after-hours trading on Thursday, featuring at the top of the Stocktwits trending list, as the company’s substantial push into artificial intelligence and a special warrant issue failed to cover up for the weak fundamental performance.

AI Plans

Opendoor plans to roll out over a dozen AI-driven products while shifting to a mandatory in-office policy and reducing dependence on consultants, the company announced in its quarterly report on Thursday. The strategy also includes boosting home acquisitions by at least 35%, enhancing pricing accuracy and resale speed, and cutting costs.

“Our business will succeed by building technology that makes selling, buying, and owning a home easier and more joyful,” CEO Kaz Nejatian said in a statement, stressing that Opendoor should be seen as a “software and AI company.”

Results and Outlook

However, its quarterly performance and forecast were a dampener. Sales in the third quarter declined 34% to $915 million, and net loss widened to $90 million from $78 million. Homes sold, purchased, and under contract decreased.

The company expects quarterly revenue and contribution margins to decline quarter over quarter in Q4, due to low inventory levels resulting from reduced acquisition volumes in Q3. Adjusted operating loss is expected to be in the high $40 million to mid-$50 million range.

“Our results in the upcoming quarter are largely the outcome of us managing decisions that were made several months ago. We’re focused on making the right long-term decisions for the business, not managing to short-term guidance,” the company’s management said in its earnings press release.

Retail Investors Turn Bullish

On Stocktwits, the retail sentiment shifted to ‘extremely bullish’ as of late Thursday, from ‘bearish’ the previous day, amid several users posting comments seemingly intended to boost the stock, including phrases like ‘we shall win’ and ‘Open army.’

“$OPEN weak hands get the hell out! Im buying tomorrow,” said one of them.

A few users also praised the company’s analyst call, which they said boosted their confidence in the company.

Special Warrants

Opendoor also announced special warrants, one for each shareholder who held 30 company shares as of 5 pm ET on Nov. 18. The warrants are split into three series — K, A, and Z — with each offering a different exercise price, namely, $9 (Series K), $13 (Series A), and $17 (Series Z).

A Stocktwits user noticed that the series’s acronym is KAZ, the first name of Opendoor’s CEO.

As of the last close, Opendoor’s stock has gained 310% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)