Advertisement|Remove ads.

Opendoor's Stocktwits Activity Skyrockets: Retail Chatter Echoes Pandemic-Era Frenzy

Opendoor Technologies (OPEN) saw a significant 211,400% increase in retail user message counts on Stocktwits over the last month, mirroring a frenzy similar to that of the meme stock rallies seen during the pandemic, such as GameStop.

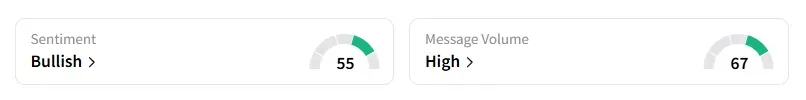

Retail sentiment on Opendoor was unchanged and in the ‘bullish’ territory compared to a day ago, with chatter at ‘high’ levels, according to data from Stocktwits.

According to an SEC filing on Tuesday, investment management firm Vanguard Group bought nearly 66.5 million shares of Opendoor on June 30.

On Monday, the company had adjourned a special meeting of shareholders, which was to be held to consider proposals related to a discretionary reverse stock split.

Opendoor said that with the stock facing volatility in the last few weeks, the board opted to delay the special meeting to give more time for reviewing market conditions and pricing trends.

The stock traded at $2.02 on Wednesday before the bell, compared to the July 14 closing price of $0.90.

Shares since July 14 have jumped 124% but then were down 1.5% in premarket trading on Wednesday.

A bullish user on Stocktwits noted that meme stock rallies are back.

Over the past few weeks, several stocks from Opendoor to Kohl’s have seen a meme stock-like rally with users on Stocktwits calling out short interest.

According to Koyfin, short interest on Opendoor was at 18.63% as of July 30.

Another bullish user on Stocktwits said that the run for Opendoor’s stock is not over.

The stock has jumped over 28% so far this year and lost about 12% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elizabeth_warren_original_2_jpg_bd4f84b387.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212700544_jpg_8378e13131.webp)