Advertisement|Remove ads.

Visa Stock Dips Premarket After Flat 2025 Forecast, But CEO Sees ‘Lots of Opportunity’ In Stablecoin Adoption

Visa (V) stock slipped 2.1% in premarket trading on Wednesday, despite the company beating its profit forecast, as it did not update its fiscal year profit forecast.

The company said that it continues to expect earnings per share to increase by a percentage in the low teens and revenue to rise by low double-digit percentage points.

The outlook came despite the company handily topping Wall Street’s estimates for profit and revenue. It reported adjusted earnings of $2.98 per share for the fiscal third quarter, while analysts expected it to post $2.85 per share, according to Fiscal.ai data. Its quarterly revenue of $10.2 billion also came in ahead of estimates of $9.85 billion.

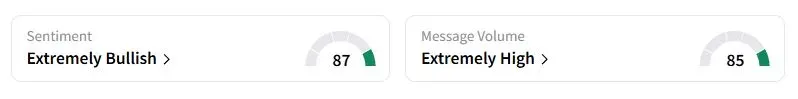

Retail sentiment on Stocktwits about Visa was in the ‘extremely bullish’ territory at the time of writing, while retail chatter was ‘extremely high.’

“Consumer spending remains resilient, with continued strength in discretionary and non-discretionary growth in the U.S.,” the company said in a statement. It also saw “no meaningful” impact from tariffs.

Visa, the top payments processor, reported that its cross-border volumes increased by 12% and the number of processed transactions rose by 10%. Earlier this month, American Express had also topped profit estimates on robust consumer spending.

According to a Bloomberg News report, Mizuho Securities analyst Dan Dolev stated that the company’s failure to raise its full-year outlook is likely the reason behind the decline in share prices.

During the conference call with analysts, Visa executives said the company sees a “lot of opportunity” regarding stablecoins, specifically in remittances.

“For example, sending money from a Visa card to a bank account in an emerging market, we're reliant on local banking infrastructure. So in these types of use cases, stablecoins could enable us to have faster cross-border transactions,” CEO Ryan McInerney said.

Last month, investors were spooked after a landmark stablecoin legislation advanced in Congress. Digital tokens, typically linked one-to-one with the dollar, enable consumers to pay merchants directly from their cryptocurrency wallets. This method bypasses traditional banking and card networks, raising concerns about Visa and its peers. However, analysts have largely dismissed these concerns.

Visa stock has gained 10.5% this year.

Also See: Oil Prices Rise On Trump’s Threats To Move Forward Russia Tariff Deadline

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_applovin_OG_jpg_12b141cd06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_crypto_atm_OG_jpg_5c3f726c93.webp)