Advertisement|Remove ads.

Oracle’s AI World Conference To Shed Light On Cloud Margins And Ambitions: Report

Oracle Corp. (ORCL) shares drew investor attention as the tech giant hosts the AI World conference starting Monday in Las Vegas, to bring the focus on its AI-based businesses and partnerships.

The event will be held from October 13 to October 15. According to a Bloomberg report, all eyes will be on whether the company can justify its lofty valuation through continued growth and improved profitability. Oracle’s stock price has surged 85% year-to-date, and nearly $400 billion has been added in market value.

Co-CEO Mike Sicilia and company founder Larry Ellison are scheduled to headline the event, with Ellison's keynote expected to address Oracle’s AI ambitions and financial targets.

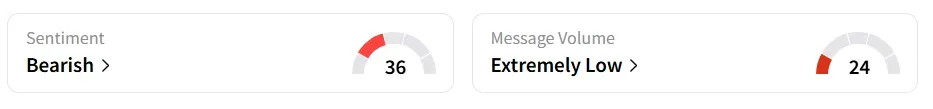

Oracle stock traded over 4% higher on Monday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘extremely low’ message volume levels.

The report stated that the core of this week's AI World conference is Oracle’s expanding cloud business, a critical driver of recent gains but also a source of scrutiny due to margin pressure.

On Thursday, the company will hold an investor day, where updated projections may help clarify the cost-benefit balance of Oracle’s cloud strategy, the report cited.

On Monday, Keith Bachman, an analyst at BMO Capital, revised the price target on the tech giant to $355 from $345 and reiterated an ‘Outperform’ rating on the stock, according to TheFly.

Bachman suggests that Oracle’s upcoming Financial Analyst (FA) event could act as a meaningful stock catalyst by potentially revealing more specifics on the company’s long-term financial roadmap.

Oracle stock has gained over 84% year-to-date and over 74% in the last 12 months.

Also See: Plug Power Gets Price Target Boost Amid Policy Tailwinds

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229072591_jpg_18a80f859a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931369_jpg_250f28d52d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)