Advertisement|Remove ads.

Plug Power Gets Price Target Boost Amid Policy Tailwinds

Plug Power Inc.(PLUG) received a boost from Susquehanna on Monday, which raised its price target on the hydrogen fuel cell maker to $3.50 from $1.80, while maintaining a ‘Neutral’ rating on the stock.

According to a report by TheFly, Susquehanna’s price target hike reflects the firm’s more optimistic industry outlook as key clean energy incentives remain in place ahead of third-quarter (Q3) earnings.

Susquehanna revised its forecasts and price targets across the sector, citing strengthened support from U.S. policy. The firm’s "incrementally more bullish" stance comes on the heels of continued political backing for the Inflation Reduction Act’s core incentives.

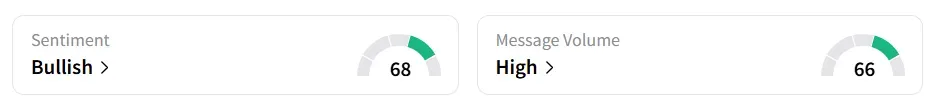

Plug Power stock traded over 14% higher on Monday mid-morning. On Stocktwits, retail sentiment around the stock shifted to ‘bullish’ from ‘extremely bullish’ territory the previous day amid ‘high’ message volume levels.

The stock saw a 103% surge in message volume levels over the last month.

Susquehanna stated that it prefers companies with domestic manufacturing capabilities and “robust” order backlogs.

A bullish Stocktwits user highlighted the fact that Plug Power has support from governments and major corporations.

The company’s recent delivery of a 10-megawatt electrolyzer to the Portuguese energy firm, Galp, has demonstrated its efficiency in hydrogen projects.

In September, Plug Power said its Georgia facility reached a production milestone, generating 324 metric tons of green hydrogen in August, the highest monthly total in the plant’s history. The company reported 97% uptime and 99.7% availability, metrics indicating stability and efficiency of its proprietary GenEco electrolyzer technology at an industrial scale.

Plug Power stock has gained 84% year-to-date and over 88% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)