Advertisement|Remove ads.

OraSure Receives Warning From Ron Zwanziger: Entrepreneur Warns Of Adversarial Path If Board Continues To Refuse Buyout Offer

Medical device company OraSure Technologies (OSUR) received a letter from healthcare entrepreneur Ron Zwanziger on Monday stating that he may pursue a more "adversarial path" if the board continues to resist his offer to buy the company, Reuters reported on Monday.

Zwanziger made an unsolicited all-cash offer for the company earlier in the summer but was rebuffed. The entrepreneur stated in his letter that other investors have grown concerned and reached out to him, as per the report.

"If the board is not willing to entertain a collaborative discourse, we will be left with no choice but to consider all alternatives available," the letter said, without detailing the alternative options. "We would prefer to work together with you in a collaborative fashion to realize the full value potential for all shareholders, rather than pursuing a more adversarial path," the letter read, as per the report.

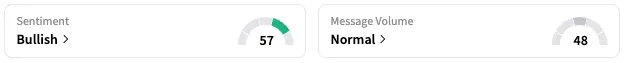

On Stocktwits, retail sentiment around OSUR stock rose from ‘neutral’ to ‘bullish’ territory over the past 24 hours, while message volume remained at ‘normal’ levels.

Zwanziger submitted a proposal to buy OraSure for between $3.50 and $4.00 a share in June, the report said. The stock currently trades below these levels. "As time passes without any productive engagement between ourselves, not only do your cash reserves and share price decline, but our offer price may be lowered or withdrawn," the letter said.

The entrepreneur also highlighted in his letter that the company’s second-quarter revenue dropped, and its share repurchase program in March ‘failed’ to boost its share price, the report said.

For the three months through the end of June, the firm’s total net revenues fell 43% year-on-year to $31.24 million, while diluted and adjusted loss per share stood at $0.19 compared to a profit of $0.08 in the corresponding quarter of 2024.

OSUR stock is down by 12% this year and by about 28% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)