Advertisement|Remove ads.

Origin Materials Stock Gains As Q4 Results Beat Expectations: Retail Sentiment Turns Bullish

Shares of Origin Materials Inc. (ORGN) gained nearly 5% during Thursday’s regular trade and extended gains during after-market hours after the company’s fourth-quarter results beat Wall Street expectations.

Origin Materials posted a loss of $0.10 per share in Q4, slightly lower than the expected loss of $0.11 per share. However, the company’s performance in this metric was marginally worse than in the same period a year earlier, when it posted a loss of $0.09 per share.

Its revenue stood at $9.22 million during the quarter, slightly ahead of the estimated $9.08 million. However, on a year-on-year basis, this is a decline of over 29%.

Origin Materials has met earnings expectations only twice in the past five quarters, while it beat revenue estimates in three quarters.

“This year was transformational for Origin and Q4 was an inflection point for our caps and closures business," said Origin CEO and Co-Founder John Bissell.

The company finished fabricating its first PET cap manufacturing line and commenced commercial production in Q4. It also revealed that it has manufactured “millions of caps” in the past few months, many of which are now in the hands of some of the “largest and most famous brands in the world.”

Origin’s revenue for fiscal year 2025 stood at $31.28 million. The company has forecast fiscal year 2026 revenue in the $110 million to $140 million range.

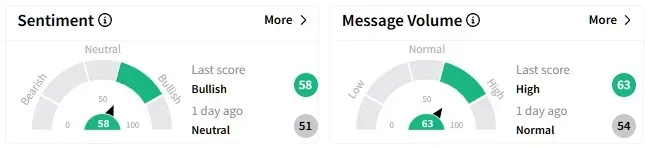

Reacting to the earnings, retail sentiment on Stocktwits around the Origin stock surged to enter the ‘bullish’ (58/100) territory from ‘neutral’ a day ago.

Origin Materials’ stock has shed a third of its value year-to-date.

In contrast, it has gained over 73% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)