Advertisement|Remove ads.

Oscar Health Stock Soars On Upbeat Q1 Earnings: Retail Stays Extremely Bullish

Shares of Oscar Health, Inc. (OSCR) ripped nearly 27% on Wednesday after it reported better-than-expected first-quarter (Q1) earnings and reaffirmed the outlook for 2025.

Oscar Health reported total revenue of $3.05 billion, up from $2.14 billion in the corresponding period of 2024, and above an analyst estimate of $2.87 billion, as per Finchat data.

The increase in revenue was primarily due to higher membership, the company said. Oscar ended the quarter with more than two million total health plan members, marking a jump of over 40% from the corresponding period of 2024.

Diluted earnings per share (EPS) came in at $0.92, up from $0.62 in Q1 2024, and above an estimated $0.81.

Medical loss ratio, a key metric tracking the percentage of premiums paid out for medical expenses, rose slightly to 75.4% in the quarter, up from 74.2% in the corresponding quarter of 2024.

CEO Mark Bertolini said that the company reported “strong financial results” in the quarter.

“We delivered continued top-line growth and bottom-line performance with significant year-over-year increases in revenue and net income. We continue to expect meaningful margin expansion this year as we deliver superior value to our members and partners,” he said.

The company reaffirmed its full year outlook including total revenue of $11.2 billion to $11.3 billion, a medical loss ratio of 80.7% to 81.7%, and earnings from operations of $225 million to $275 million.

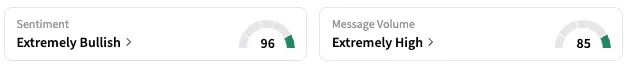

On Stocktwits, retail sentiment around Oscar remained in the ‘extremely bullish’ territory over the past 24 hours while message volume jumped from ‘high’ to ‘extremely high’ levels.

OSCR stock is up by about 22% this year but down by about 16% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Deere_resized_a913c16f0a.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_b2gold_jpg_2d344842dd.webp)