Advertisement|Remove ads.

PacBio Stock Soars On Plans To Reduce Spending Over NIH Funding Uncertainty, Tariffs: Retail Is Overjoyed

Shares of PacBio (PACB) traded nearly 20% higher on Wednesday after the company said it is executing a plan, including job cuts, to reduce the annualized operating expense run rate by $45 million to $50 million by the end of the year.

The company, which manufactures advanced sequencing solutions to help scientists resolve genetically complex problems, had previously forecast a run-rate of $270 million to $280 million.

PacBio said that the decision to reduce spending is in response to market uncertainty, including academic and National Institutes of Health (NIH) funding and new tariffs under the Trump administration.

The life science technology company now expects its year-end cash and investments balance to be higher than its previous guidance of approximately $260 million.

PacBio reiterated its previous financial guidance for full-year 2025 revenue of between $155 million and $170 million and 2025 adjusted gross margin between 35% and 40%. The company also reiterated its plan to reach positive cash flow by the end of 2027.

The firm also reported preliminary revenue of $36.9 million for the quarter ended March 31, lower than the $38.8 million reported in the corresponding quarter of 2024 but exceeding an analyst estimate of $33.53 million, according to FinChat data.

The increase in revenue was spurred by a surge in consumable revenue, which reached a record of $20.1 million.

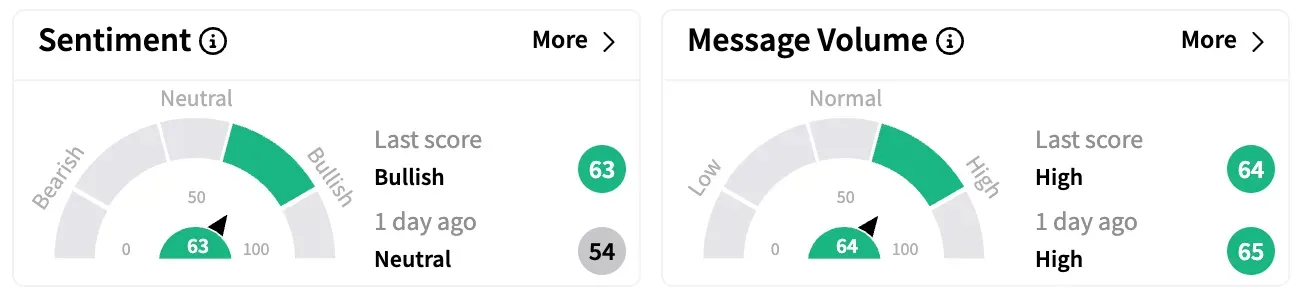

On Stocktwits, retail sentiment around PacBio shares rose from ‘neutral’ to ‘bullish’ while message volume remained ‘high’ over the past 24 hours.

PACB shares are down by over 20% this year and by over 60% over the past 12 months.

Also See: Ford Stock In Spotlight After Bernstein Downgrade, Price Target Cut: Retail Stays Pessimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229072591_jpg_18a80f859a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227931369_jpg_250f28d52d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2253201649_jpg_ff6c9e331b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)