Advertisement|Remove ads.

Pagaya Retail Traders Praise Q2 Guidance As Chatter Sees A 46% Spike In 24 Hours

AI-powered infrastructure provider for financial services, Pagaya Technologies (PGY), released preliminary second-quarter (Q2) 2025 figures on Thursday, showing stronger-than-expected performance across key areas.

Following the results, Pagaya stock surged by more than 22% on Thursday afternoon.

The company anticipates that its network volume, total revenue, net income, and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) will exceed its earlier projections.

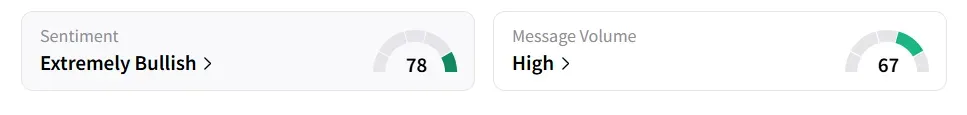

On Stocktwits, retail sentiment toward Pagaya improved to ‘extremely bullish’ (78/100) from ‘bullish’ territory a day ago, amid ‘high’ (67/100) message volume levels.

The message count for the stock jumped by over 46% in the last 24 hours.

For the quarter ending June 30, Pagaya expects network volume to reach approximately $2.6 billion, surpassing its prior guidance of between $2.3 billion and $2.5 billion.

Meanwhile, total revenue is projected at roughly $326 million, surpassing the $290 to $310 million estimate. GAAP (generally accepted accounting principles) net income is expected to come in around $17 million, well above the $0 to $10 million range.

Adjusted EBITDA is forecasted at approximately $86 million, near the high end of its target range of $75 million to $90 million.

Pagaya stated that it is exploring ways to optimize its balance sheet and reduce the cost of capital on existing debt, in support of ongoing expansion and improved margins.

The firm reaffirmed it does not intend to issue new equity or equity-linked securities in the near term.

The company is expected to publish its full second-quarter (Q2) 2025 financial report on Aug. 7, 2025.

Pagaya utilizes AI, machine learning, and a vast data network to provide consumer credit and financial products through its partners.

Pagaya stock has surged over 200% year-to-date and 96% in the last 12 months.

A bullish Stocktwits user sees a good long-term growth for the stock.

Another user highlighted Pagaya’s better performance.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)