Advertisement|Remove ads.

PagerDuty Stock Rises After-Hours On Q4 Beat, $150M Stock Buyback Plan: Retail’s Mixed

PagerDuty, Inc. (PD) shares climbed in Thursday’s after-hours session after the digital operations management platform provider announced a fourth-quarter beat and a $150-million new stock buyback program. However, the forward guidance was mixed.

The San Francisco, California-based company reported adjusted earnings per share (EPS) of $0.22 for the fourth quarter of the fiscal year 2025, up from the year-ago’s $0.17.

The Finchat-compiled consensus and PagerDuty’s guidance were at $0.16 and $0.15-$0.16, respectively.

The San Francisco, California-based company’s revenue grew 9.3% year over year (YoY) to $121 million, aligning with the third-quarter growth and exceeding the guidance of $118.5 million to $120.5 million.

PagerDuty generated a free cash flow of $28.6 million for the quarter. It boasted of a cash position of $570.8 million as of Jan. 31.

Jennifer Tejada, CEO of PagerDuty, said, “Our relentless focus on operational excellence and efficient growth delivered another strong quarter, exceeding both top and bottom line guidance ranges.

Among operational metrics, annual recurring revenue (ARR) stood at $494 million as of Jan. 31, up 9% YoY. Customers with ARR over $100,000 numbered 849 at the end of the quarter, a 6% increase, the same pace as in Q3. The dollar-based net retention rate was 106% as of Jan. 31.

Free and paid customers climbed 10% to 31,000, at a slightly slower pace than the third quarter’s 11% growth. The total paid customer count increased slightly from a year ago and the previous quarter to 15,114

PagerDuty said its remaining performance obligations (RPO) were $440 million, of which about $302 million will be recognized over the next 12 months.

The company's board authorized a new stock buyback program of up to $150 million in common stock.

Looking ahead, PagerDuty guided to first-quarter adjusted EPS in the range of $0.18-$0.19 and revenue in the range of $118 million to $120 million. This compares to the consensus estimates of $0.19 and $121 million, respectively.

The company’s fiscal year 2026 outlook calls for adjusted EPS and revenue of $0.90 to $0.95 and $500 million to $507 million, respectively, compared to the average analysts’ estimate of $0.89 and $510.07 million, respectively.

The company said its artificial intelligence (AI) innovation, combined with new features added to all PagerDuty Incident Management packages, positions it well to accelerate enterprise momentum in the second half.

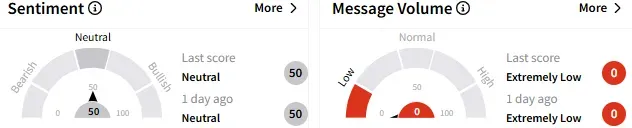

On Stocktwits, the retail sentiment toward PagerDuty stock remained ‘neutral’ (50/100), while the message volume stayed at ‘extremely low’ levels.

PagerDuty stock ended Thursday’s after-hours session up 4.36% at $16.29. The stock has lost over 13% for the year-to-date period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: DocuSign Stock Rips Higher After-Hours On Q4 Beat, Positive Outlook: Retail Lauds ‘Good’ Report

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)