Advertisement|Remove ads.

Palantir Stock Rises Defying Market Downturn: Retail Shrugs Off Upside As ‘Dead-Cat Bounce’

As markets continued to slide over Trump’s tariff wars, Palantir Technologies, Inc. (PLTR) stock saw a volatile ride on Monday, moving between $66.12 and $81.80. After a trading halt earlier in the session due to the volatility, it has resumed trading.

The stock has pulled back notably from its all-time high of $125.41, reached on Feb. 19.

Denver, Colorado-based Palantir provides an artificial intelligence (AI)- enabled data analytics platform. The company derived over 63% of its 2024 revenue from the U.S. government, while a little over 33% came from overseas customers.

The Department of Defense’s (DoD) move to cut costs following recommendations by the Department of Government Efficiency (DOGE), headed by Tesla CEO Elon Musk, exerted downward pressure on Palantir stock even before President Donald Trump’s tariffs hit the market hard.

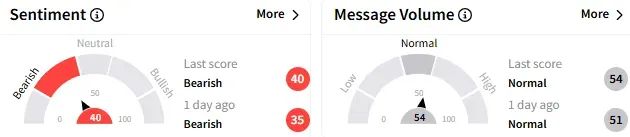

On Stocktwits, retail sentiment toward Palantir stock remained ‘bearish’ (40/100), and the message volume on the stream stayed ‘normal.’

A bearish watcher said the rally in Palantir stock in late-morning trading was a “dead-cat” bounce—a term used to refer to a brief recovery in the price of a declining asset.

Another user was pessimistic about Palantir’s long-term prospects. They said the stock could languish around $30 in a year or two.

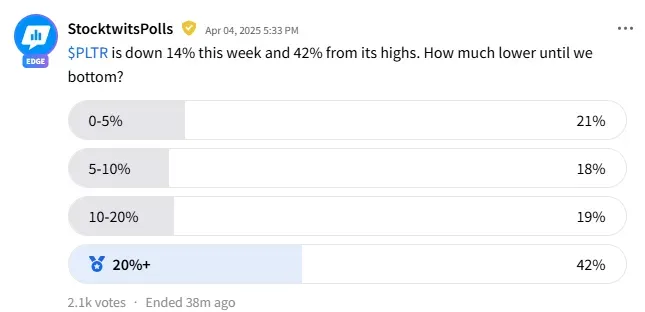

A poll conducted on Stocktwits, which received 2,100 responses, found that 42% of the respondents expect a pullback of over 20% before the stock hits bottom. The proportion of respondents who said they expect a 10-20% plunge before bottoming is 19%.

Eighteen percent braced for a 5-10% slump, while 21% called for bottom or up to 5% loss.

At last check, Palantir stock rallied over 1% to $74.83 but is down 2.14% this year. The Koyfin-compiled consensus price target for Palantir is $86.77, implying scope for roughly 17% upside potential.

Last week, Daiwa Securities initiated coverage of Palantir stock with a 'Neutral' rating and $80 price target, TheFly reported.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es6_jpg_b768981c5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228901180_jpg_0c2cc7dc28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)