Advertisement|Remove ads.

Victoria’s Secret CFO Sees Momentum In Fourth Quarter – What’s Driving The Optimism?

- Victoria’s Secret is seeing strong momentum heading into the latter part of the fiscal year.

- The company reported Q3 revenue of $1.472 billion, a 9% year-on-year increase.

- Victoria’s Secret raised its full-year sales outlook to the range of $6.450 billion to $6.480 billion.

Victoria’s Secret & Co.’s (VSCO) Chief Financial and Operating Officer, Scott Sekella said the company is seeing strong momentum heading into the latter part of the fiscal year, pointing to better-than-expected performance and consumer enthusiasm around Holiday sales.

Sekella said shoppers responded well to holiday offerings across beauty, sleep, and its PINK line, driving strong sales during Black Friday and Cyber Monday. “We are winning in big moments like Black Friday and Cyber Monday, and we also have a robust gifting assortment across key categories,” he said.

Holiday Demand Boosts Momentum

Sekella added that the retailer is already preparing its Valentine’s Day floor set, which typically represents one of the brand’s most important sales periods. He said the early planning and strong recent trends give the company confidence in achieving a solid finish to fiscal 2025.

He noted that the company delivered standout results in the third quarter, crediting a mix of product innovation and stronger in-store execution.

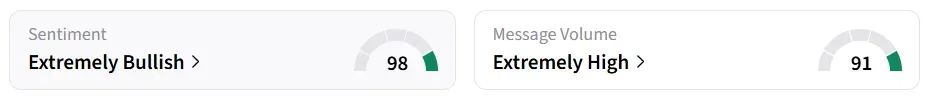

Following the third-quarter (Q3) earnings, Victoria’s Secret stock traded over 11% higher on Friday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Q3 Performance And Guidance

The company reported Q3 revenue of $1.472 billion, a 9% year-on-year increase, with a loss per share of $0.46. Both revenue and loss per share came in better than the analysts’ consensus estimate of $1.4 billion and $0.59, respectively, according to Fiscal AI data.

The retailer raised its full-year sales outlook to $6.450 billion to $6.480 billion, with adjusted earnings per share (EPS) between $2.40 and $2.65. For the fourth quarter, the company sees sales in the range of $2.170 billion to $2.200 billion.

VSCO stock has gained over 11% in 2025 and over 7% in the last 12 months.

Also See: New York Times Sues Perplexity AI Over Unauthorized Content Use: What Does The Lawsuit Say?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_home_depot_resized_jpg_41f1dc8f5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260490321_1_jpg_e83ecbf5cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ethereum_blue_original_jpg_b6e7cc57f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)