Advertisement|Remove ads.

Paramount’s Q3 Streaming Surge Delights Retail Investors, But Broader Market Fears Over Major Misses

Paramount Global ($PARA) reported a mixed bag in its third-quarter (Q3) results on Friday, with strong streaming growth overshadowed by declining TV and film revenues.

The media giant’s Q3 adjusted earnings per share (EPS) of $0.49 significantly outpaced Wall Street’s estimate of $0.24, but revenue of $6.73 billion missed the $6.95 billion consensus.

The company’s direct-to-consumer (DTC) segment, which includes Paramount+, saw revenue climb 10% year-over-year to $1.86 billion.

Paramount+ added 3.5 million subscribers during the quarter, bringing its total to 72 million, slightly below the FactSet expectation of over 75 million.

Despite the shortfall, Paramount highlighted that its DTC segment achieved profitability for the second consecutive quarter, improving by more than $1 billion over the past year.

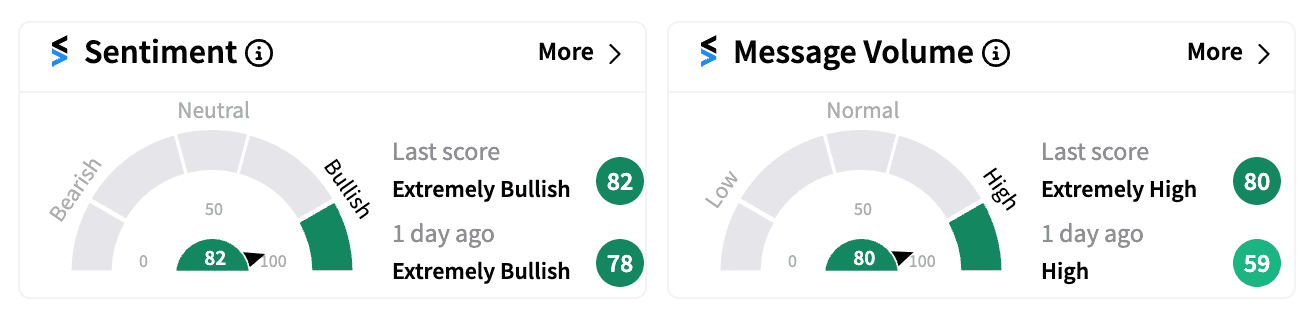

On Stocktwits, retail sentiment climbed more into the ‘extremely bullish’ territory despite broader market skepticism.

Paramount’s streaming growth “is the most important piece right now,” said one bullish user.

Another noted that Paramount converts “85% of trial subscribers into paying customers, so expect Q4 revenue to improve.”

However, weaknesses in other areas weighed on overall investor sentiment.

Paramount’s filmed entertainment revenue plunged 34% to $590 million, and TV-media revenue dropped 6% to $6.731 billion.

The company’s TV segment — which includes CBS, MTV, and Nickelodeon — suffered a 7% decline in subscription revenue and a 2% dip in ad revenue due to softness in the linear ad market.

Theatrical revenue also tumbled 71%, hit by fewer film releases compared to the prior year.

Looking ahead, Paramount expects its streaming platform to reach domestic profitability by fiscal year 2025 and sees potential growth in direct-to-consumer advertising in the fourth quarter.

The company is also optimistic about closing its Skydance transactions in the first half of 2025, following prolonged negotiations with multiple parties.

Paramount shares fell over 4% in early trading on Friday.

Year-to-date, PARA stock is down 22%, contrasting with the S&P 500’s 25% gain over the same period.

For updates and corrections, email newsroom@stocktwits.com

Read next: Sony Stock Jumps Pre-Market As Profit Booms Nearly 70%: Retail Buzz Builds

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)