Advertisement|Remove ads.

Paramount Clears Key US Antitrust Review In $77.9 Billion Pursuit Of Warner Bros. Discovery

- With the statutory review window now closed, there is no longer a U.S. legal barrier preventing the companies from finalizing the acquisition.

- Paramount must still negotiate and sign a definitive merger agreement with WBD, and obtain shareholder approval.

- On Tuesday, Warner Bros opened a brief window to discuss Paramount’s offer.

Paramount Skydance Corp. (PSKY) said on Friday that it has cleared a key U.S. antitrust milestone in its proposed all-cash takeover of Warner Bros. Discovery Inc. (WBD).

According to a Securities and Exchange Commission (SEC) filing, the 10-day waiting period under the Hart-Scott-Rodino Antitrust Improvements Act expired on February 19 after Paramount certified compliance with a Justice Department request for additional information tied to the transaction.

U.S. Review Concludes

With the statutory review window now closed, there is no longer a U.S. legal barrier preventing the companies from finalizing the acquisition. However, the transaction is not yet complete.

Paramount must still negotiate and sign a definitive merger agreement with WBD, obtain shareholder approval and secure clearance from regulators in other jurisdictions. The Justice Department had issued a “Second Request” in late December 2025, requiring additional documentation and data as part of its antitrust review.

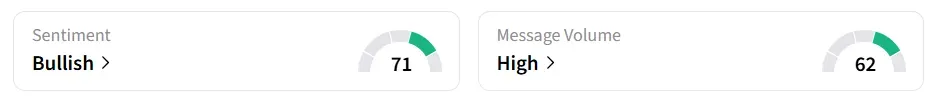

Paramount Skydance stock inched 0.7% lower on Friday morning. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

High-Stakes Battle

Paramount has pursued Warner Bros. since September, initially prompting the media company to explore strategic alternatives. After losing out to Netflix, Paramount launched a hostile tender offer at $30 per share, which it later raised.

On February 11, Paramount increased its $30-per-share cash offer and introduced a ticking fee, which would add an extra $0.25 per share in cash for WBD investors.

On Tuesday, Warner Bros opened a brief window to engage in discussions with Paramount even as it scheduled a March 20 shareholder vote on its proposed merger with Netflix, Inc. (NFLX).

PSKY stock has declined by over 7% in the last 12 months.

Also See: Why Did TRNR Stock Plummet 32% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246131051_jpg_78a656bc06.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)