Advertisement. Remove ads.

Paramount Stock Becomes Top Trending Ticker On Stocktwits After Reports Of Bronfman’s $4.3B Offer

Paramount Global (PARA) became the top trending ticker on Stocktwits before the opening bell on Tuesday after reports indicated Edgar Bronfman Jr. submitted a surprise $4.3 billion bid to acquire the firm.

The company’s stock declined nearly 3% following the news, first reported by the Wall Street Journal.

Bronfman Jr. 's bid targets National Amusements, the Redstone family holding company that controls a majority stake in Paramount, and throws a curveball at the previously planned sale to tech entrepreneur David Ellison and his company, Skydance Media.

The Ellison-led group offered $2.4 billion for National Amusements, with an additional $6 billion earmarked for buying Paramount shares and debt reduction. Its proposal also included merging Skydance into Paramount for shares valued at $4.75 billion.

Bronfman will reportedly argue that his proposal is more attractive because it will result in less dilution for non-Redstone shareholders of Paramount.

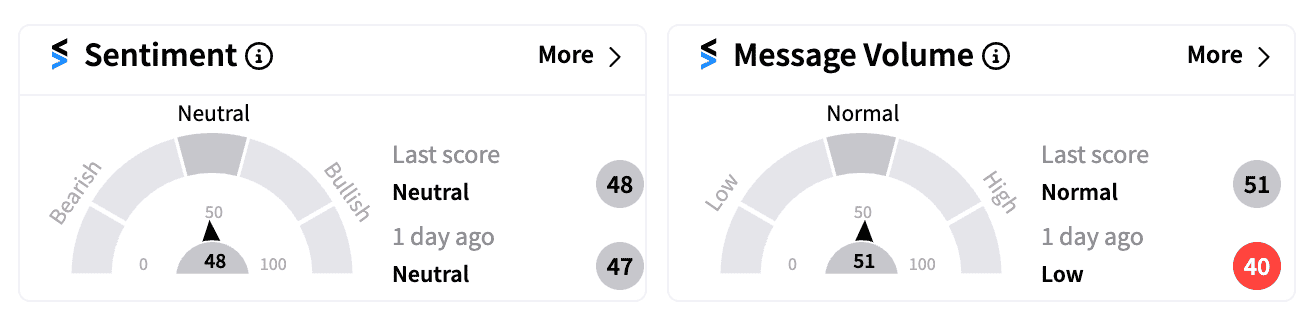

On Stocktwits, sentiment for PARA remained ‘neutral’ (48/100) compared to the previous day’s mood. However, message volume surged by 660%, indicating significant interest from retail investors.

"From a business perspective, it's a genius move by Edgar," wrote one user on PARA's Stocktwits feed. "He let David [Ellison] do all the heavy work to try and close a deal, and he stepped it up by saying I'll do the same thing and I won't dilute to B shareholders."

"The fact is this is a better deal by far for us as we avoid 50% dilute. Even better is Brof is a real business man. Not here for his "Hobby". People may not be aware that he also owned Universal Studios in the past," another user commented.

Bronfman first diversified the Seagram liquor business in 1995 by acquiring MCA, which included Universal Music Group, Universal Studios, and two theme parks. He returned to the entertainment industry in 2003 by acquiring Warner Music Group, later selling it in 2011.

Despite a recent stock surge, PARA is still down over 23% year-to-date, as consumer viewing habits increasingly shift from traditional TV to streaming services.

Earlier this month, Paramount reported an 11% drop in total revenue in the second quarter and expects a $300 million to $400 million restructuring charge in the third quarter.

/filters:format(webp)https://news.stocktwits-cdn.com/large_generic_thread_textile_image_jpg_74c55aaaf1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_astral_4b1042f45b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trading_Floor_2_jpg_779bc9d8d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_resized_vodafone_idea_image_jpg_9f1805a814.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2020/04/NAB.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)