Advertisement|Remove ads.

Perpetua Resources Stock Rises On Final US Permit For Critical Antimony Mine — Retail Worried About Cash Burn

Perpetua Resources (PPTA) stock was up 1.8% in premarket trade on Tuesday after the U.S. government issued the final federal permit for the company’s proposed gold and antimony mine in Idaho.

The United States Army Corps of Engineers issued the Clean Water Act permit for the Stibnite mine on Monday, enabling the company to progress towards production.

The project is expected to be among the highest-grade open-pit gold mines in the United States, with approximately 4.8 million ounces of gold reserves.

The project also has an estimated 148-million-pound antimony reserve — the only identified reserve of the critical element in the U.S.— and could supply 35% of the required antimony demand during the initial six years of production.

The Donald Trump administration had selected the mine among 10 projects whose approval processes were to be fast-tracked to raise critical element production.

“This mine marks a major step by this administration to secure critical mineral supply chains, reduce reliance on foreign countries, accelerate energy projects, unlock domestic resources, and drive American energy dominance on the global stage,” the U.S. Department of the Interior said.

Antimony, which is used in batteries, is a crucial element in producing military munitions and flame retardants.

The prices of the metalloids have jumped since the top producer, China, banned exports in December.

The company said it is focused on finalizing the remaining state permits and securing project financing needed to begin construction.

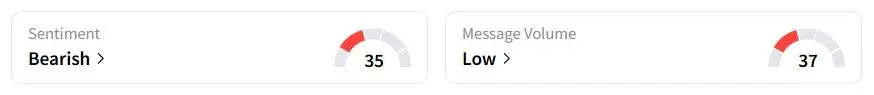

Retail sentiment on Stocktwits was still in the ‘bearish’ (35/100) territory, while retail chatter was ‘low.’

One retail trader viewed the approval as a positive for the stock but warned that its cash burn remains “an elephant in the room.”

Perpetua stock has gained 18.1% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2173218234_fotor_2025021091559_3d9884379a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Big_Bear_jpg_8fce0f24aa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1242030871_jpg_12741b089b.webp)