Advertisement|Remove ads.

Persistent Shares Soar To 4-Month High On Strong Q2; Analyst Sees Rally To ₹6,500

Persistent Systems’ shares surged as much as 7% to ₹5,730 on Wednesday, their highest in nearly four months.

The IT services firm reported a net profit of ₹471.4 crore for the July-September quarter, a 45% increase from last year. The figure reportedly surpassed street expectations. Operating profit (EBIT) rose 43.7% to ₹583.7 crore.

Revenue from operations grew 23.6% to ₹3,580.7 crore, supported by broad-based growth across major verticals. The company recorded total contract value (TCV) of $609.2 million and annual contract value (ACV) of $447.9 million for the quarter.

“Our AI strategy builds on a strong platform-led foundation and is powered by deep domain knowledge, differentiated IPs, accelerators and strategic partnerships. This integrated approach brings together enterprise readiness for AI transformation, engineering hyper-productivity and business hyper-productivity, enabling clients to scale innovation, modernize their core and achieve measurable impact fast,” said Sandeep Kalra, Chief Executive Officer and Executive Director.

Technical Take

Persistent Systems’ stock is currently forming a symmetrical triangle pattern, indicating a potential breakout ahead, noted SEBI-registered analyst Financial Sarthis.

A sustained close above ₹5,850 could trigger a rally toward ₹6,100 and ₹6,500 levels, while strong support is seen at ₹5,300, he added.

Brokerage Views

HSBC maintained a “hold” rating but increased its target to ₹6,000 per share, citing strong growth and improved profitability driven by deal-win recovery. However, it cautioned that rich valuations could limit further upside.

CLSA maintained a bullish outlook on Persistent Systems, reaffirming its “high-conviction outperform” rating and raising the target price to ₹8,270 per share. The brokerage noted management’s reaffirmation of the $2 billion revenue target for FY27 and projected a 29% EPS CAGR over FY25–27.

Nomura assigned a “neutral” rating with a ₹5,200 target price. It raised the company’s FY26–28 EPS estimates by 3%-5% but noted the stock trades at an elevated multiple of 37.5x FY27 EPS, suggesting limited valuation comfort.

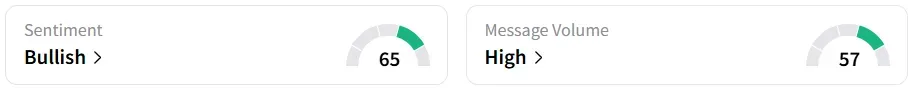

What is the retail mood on Stocktwits?

Retail sentiment on Stocktwits remained ‘bullish’, amid ‘high’ message volumes. It was ‘neutral’ last week. Persistent Systems was among the top five trending stocks on the platform.

Year-to-date, the stock has shed over 12%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)