Advertisement|Remove ads.

Peter Schiff Calls MSTR's Bitcoin-Centric Strategy A 'Fraud,' Dares Michael Saylor To Dubai Showdown

- At the time of writing, the apex cryptocurrency pared some losses and was trading at $94,967.79.

- After calling the Strategy’s business model a fraud, Schiff said he will ask Saylor for a debate when the two arrive at Binance Blockchain Week in Dubai in early December.

- Schiff further said Strategy’s “business model relies on income-oriented funds buying its ‘high-yield’ preferred shares. But those published yields will never actually be paid."

Economist Peter Schiff, a renowned gold bull on Wall Street, said that Bitcoin treasury firm Strategy’s business model is “fraud” and challenged its chair, Michael Saylor, to a debate next month.

Schiff’s attack on Strategy, which pioneered the concept of digital asset treasuries, came after Bitcoin dropped below $94,000 on Sunday, nearly eroding all of this year’s gains. At the time of writing, the apex cryptocurrency pared some losses and was trading at $94,967.79.

What Did Schiff Say?

After calling the Strategy’s business model a fraud, Schiff said he will ask Saylor for a debate when the two arrive at Binance Blockchain Week in Dubai in early December. “Regardless of what happens to Bitcoin, I believe $MSTR will eventually go bankrupt. Let’s go!” he wrote on X.

Schiff further said Strategy’s “business model relies on income-oriented funds buying its ‘high-yield’ preferred shares. But those published yields will never actually be paid.” He added that once fund managers realize this, they’ll dump the preferred shares & Strategy will not be able to issue any more of them, leading the company to a death spiral.

What Are Strategy Preferred Shares?

Strategy is the largest holder of Bitcoin in the world, with more than $61 billion in the cryptocurrency at current valuations, according to the company. The company issues preferred shares to accumulate more Bitcoin by offering investors an exposure to Bitcoin without actually owning it.

Last month, the company said that yields on the Variable Rate Series A Perpetual Stretch Preferred Stock, or STRC, will rise by 25 basis points to 10.5% in November. The move was taken to drive investor sentiment amid the weakness in Bitcoin prices. The company expects to spend about $689 million in interest expenses and dividend payments this year.

The company’s mNAV, its multiple on net asset value, or the premium in the stock price over the firm’s underlying Bitcoin holdings, stands at 1.2 after dipping below one a few weeks earlier. Investors consider an mNAV of 2 or higher to be a healthy level.

The decline comes amid a rapid decline in cryptocurrencies, with Bitcoin scaling back from the all-time highs of $126,000, following a brief escalation in the U.S.-China trade tensions. The cryptocurrency has failed to recover from those levels amid a broader risk-off sentiment on growth assets.

What Are Retail Traders Thinking?

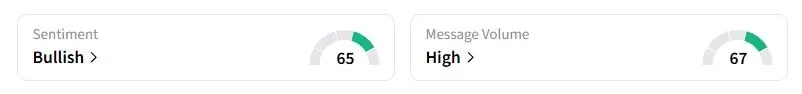

Retail sentiment on Stocktwits about Strategy was still in the ‘bullish’ territory at the time of writing. The ticker was among the top trending equity assets on the social media platform.

“Too much bearishness is kinda good for this to go up,” one user said.

“Wonder if he raised a few billion to blow some shorts out the water,” another trader said.

Strategy stock has fallen by more than 33% this year. Saylor, on Sunday, said that this will be a ‘big week’ without delving into the details. He also posted an image showing previous Bitcoin purchases by Strategy, potentially indicating further accumulation.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)