Advertisement|Remove ads.

Pfizer’s Retail Investors Turn Extremely Bullish On Blowout Q2 Earnings, Raised Outlook

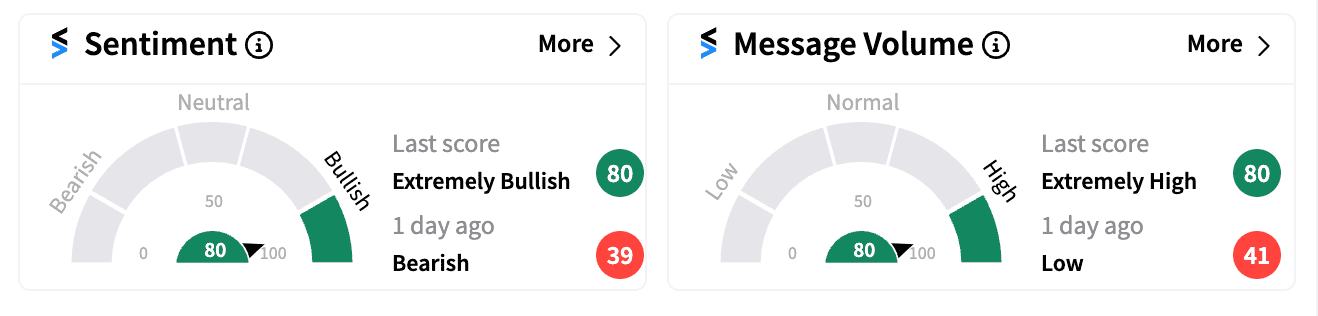

Pfizer Inc. (PFE) shares rose nearly 1% to $31.06 at the open on Tuesday after the company announced better-than-expected second-quarter results and raised its full-year outlook. Retail sentiment on Stocktwits reflected this optimism, flipping to extremely bullish (80/100) from bearish levels a day ago.

In the second quarter, Pfizer reported adjusted earnings per share (EPS) of $0.60, exceeding analyst estimates by $0.14. Revenue also came in above forecasts at $13.28 billion.

Buoyed by the strong performance, the company lifted its full-year adjusted EPS guidance to a range of $2.45-$2.65 from an earlier $2.15-$2.35. Additionally, Pfizer increased its 2024 revenue range forecast to $59.50 billion-$62.50 billion from the previous estimate of $58.50 billion-$61.50 billion.

The pharmaceutical giant has been working diligently to reassure investors that its pipeline of new drugs can compensate for the steep decline in revenue from its COVID-19 vaccine and pill, which caused the stock price to plummet by over 40% in 2023.

Retail investors on Stocktwits are expressing growing optimism amid high message volumes. Some users, like Awsi Obutu, going by the handle "HoHoHoHum", are predicting a year-end price of $40 for PFE — a level it last hit in mid-June 2023.

Pfizer is now aggressively pursuing growth through its oncology division, highlighted by the $43 billion acquisition of Seagen last year. Seagen drugs contributed $845 million in Q2 revenue, with Padcev exceeding analyst expectations. Vyndaqel, a key cardiovascular drug, also outperformed.

Stocktwits followers took note of that trajectory, with one user saying, “8 cancer blockbuster drugs (yes, 8) coming by 2030. Pfizer will be THE leader in cancer treatment. That's all you need to know.”

The company also said it’s now developing a weight-loss pill to compete with injectable options like Novo Nordisk's Wegovy, with mid-stage trials commencing this year.

Pfizer's stock has recovered modestly year-to-date, gaining 3.77%, bolstered by a cost-cutting plan aiming to save $1.50 billion by 2027. The company said it remains on track to meet those goals, giving retail investors more reason to turn bullish and look for further upside.

Photo via Vecteezy

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)