Advertisement|Remove ads.

Phillips 66 Stock In Focus After Glass Lewis Backs Elliott Nominees For Board Elections

Phillips 66 (PSX) stock will likely garner retail attention on Monday after proxy advisory firm Glass, Lewis & Co. recommended that the refiner’s shareholders vote for three board nominees from Elliott Investment Management.

Glass Lewis recommended voting for oil industry executives Brian Coffman, Sigmund Cornelius, and Michael Heim at Phillips 66’s annual shareholder meeting on May 21, Elliott said.

According to a Bloomberg News report, Glass Lewis also backed Phillips 66’s nominee Nigel Hearne.

Activist investor Elliott is pushing for a strategic shift at Phillips 66, including the sale of its midstream business and its stake in a chemicals joint venture with Chevron.

"In our view, the more compelling case is offered by Elliott, in this case by a relatively decisive margin," Glass Lewis stated.

However, Phillips 66 has said its pipelines are an essential part of the business, and there would be adverse consequences, including a high tax burden, if there is a spinoff.

“We believe the core argument that Phillips 66 has failed to drive compelling shareholder returns or a differentiated valuation as an extension of management’s pursuit of further integration is fundamentally sound,” Glass Lewis said.

The proxy advisor also supported an Elliott proposal to ensure that all Phillips 66’s directors are elected annually.

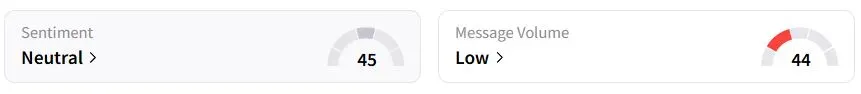

Retail sentiment on Stocktwits was in the ‘neutral’ (45/100) territory on Friday, while retail chatter was ‘low.'

The company reported a bigger-than-expected quarterly loss in April after its refining margins slumped and its refineries went through a busy maintenance schedule. Its midstream segment posted a profit of $751 million.

Phillips 66 stock has fallen 3.4% year to date (YTD).

Also See: Rio Tinto In Spotlight After US Judge Pauses Land Transfer For Copper Project

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)