Advertisement|Remove ads.

PLTR Stock In Spotlight As Company Teams Up With Fujitsu To Drive AI‑Powered Business Transformation

Palantir Technologies Japan and Fujitsu have entered into a new licensing arrangement to deploy the Palantir Artificial Intelligence Platform (AIP) for the latter’s customers across Japan.

The agreement, signed on Aug. 5, 2025, and announced on Tuesday, supports future global rollout within fiscal 2025 and aligns with Fujitsu’s mission to modernize operations. Fujitsu plans to merge Palantir AIP with its Uvance framework, intended to propel generative AI into real-world workflows, boosting business transformation domestically and abroad.

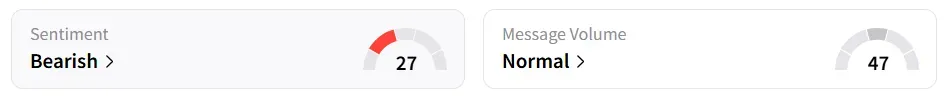

Palantir stock traded over 6% lower on Monday morning. On Stocktwits, retail sentiment around the stock remained in’bearish’ territory with the message volume improving to ‘normal’ from ‘low’ levels in 24 hours.

A bullish Stocktwits user said they are adding more of the stock.

Another user felt the stock was ‘expensive.’

Integrating AIP into Fujitsu Uvance will expedite tasks like scenario modeling, root‑cause analysis, and executive proposal drafting. When paired with Fujitsu’s own AI offerings, such as Takane and Kozuchi, the solution gains native Japanese language fluency and specialized enterprise capabilities.

The partnership is projected to generate $100 million in revenue by fiscal 2029. The alliance between the companies dates back to 2020, starting with data-driven initiatives in Japan. That strengthened in 2023 with a global license allowing Fujitsu to market Palantir Foundry.

On Monday, a research note from Citron cited that Palantir stock remains expensive even if it were to match OpenAI’s sky‑high $500 billion valuation metrics. The firm stated that Palantir’s heavy reliance on long‑term government contracts limits rapid expansion, reducing its appeal compared to that of OpenAI’s.

Palantir stock has gained over 115% in 2025 and over 400% in the last 12 months.

Also See: Nvidia-Backed Databricks Lands Massive $100B Valuation As AI Demand Surges

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kalshi_logo_jpg_d4ea268948.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1249125319_jpg_31d1207b8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)