Advertisement|Remove ads.

Palantir Stock Defies Market Slide, Soars On Shift To Nasdaq: Retail Buzz Intensifies

Shares of Palantir Technologies Inc. ($PLTR) surged more than 9% on Friday, bucking a broader market slump, after the company revealed plans to shift its stock listing from the New York Stock Exchange (NYSE) to the Nasdaq.

The stock, currently trading at record highs, is set to begin trading on the Nasdaq under its current ticker symbol, PLTR, starting Nov. 26.

The decision to move aligns Palantir with tech giants such as Meta Platforms, Inc. ($META) and Apple, Inc. ($AAPL), marking a strategic pivot to a more tech-focused exchange.

The company also anticipates meeting the criteria for inclusion in the Nasdaq 100 Index, which consists of the largest non-financial companies listed on the exchange. This could significantly increase Palantir’s visibility and attract institutional investors, as funds tracking the index would be required to buy its shares.

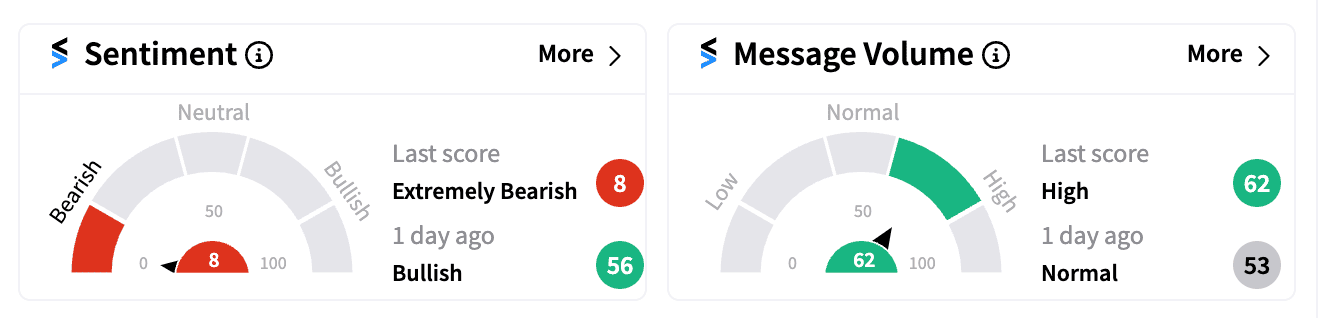

The announcement triggered a flurry of retail investor interest on Stocktwits, with Palantir quickly becoming one of the most-discussed stocks of the day.

However, retail sentiment flipped to 'extremely bearish’ as some investors raised concerns about the stock’s inflated price-to-earnings (P/E) ratio, with some opting to short it.

Palantir’s stock has been a standout performer in 2024, with a staggering 245% gain as of the last close, and its entry into the S&P 500 in September helped boost the rally.

The company’s ambitious AI-driven strategy and government contracts have been key drivers of its success, with recent earnings showing a 30% year-over-year increase in revenue, surpassing analyst expectations.

Despite this impressive performance, Wall Street analysts remain cautious. Palantir trades at a forward P/E ratio of over 130 times, and analysts have an average price target of $36.70, according to FactSet, which implies a downside of 42% from current levels.

The broader market struggled on Friday, as the post-election rally lost momentum, and stocks faced pressure from comments by Federal Reserve Chairman Jerome Powell downplaying the need to urgently cut interest rates further.

The Nasdaq fell more than 1%, adding to a week of losses across major indices.

Amid the downturn, Palantir’s resilience stood out, though it remains a polarizing stock, especially as it nears its Nasdaq debut.

A Stocktwits poll shows that 45% of retail investors think Palantir’s stock will hit $100 by the end of the year, driven by the AI boom, while 27% believe its valuation could prove to be its undoing.

For updates and corrections, email newsroom@stocktwits.com

Read next: Disney Magic Returns? Wall Street Cheers With Price Hikes After Stellar Earnings, Retail Buzz Grows

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitdeer_OG_jpg_8f9fd0249d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)