Advertisement|Remove ads.

PNB Housing In Bullish Consolidation Zone After Solid Q1, Say SEBI RAs

PNB Housing Finance shares rose 2% on Tuesday after it reported a 23% rise in net profit to ₹534 crore, driven by strong retail loan growth and margin expansion.

The housing finance firm saw its Net Interest Income rise 17% to ₹760 crore, with margins increasing to 3.74%. The loan disbursements saw 14% growth, with affordable housing disbursements rising 30%.

Asset quality improved with gross non-performing assets falling to 1.06% from 1.35%. And assets under management (AUM) rose 13% to ₹82,000 crore. The management reiterated their focus on affordable housing, with over 50% of retail disbursements now in this segment.

According to SEBI-registered analyst Saurabh Sahu, the growth momentum and improving asset quality offer confidence in sustainable performance ahead.

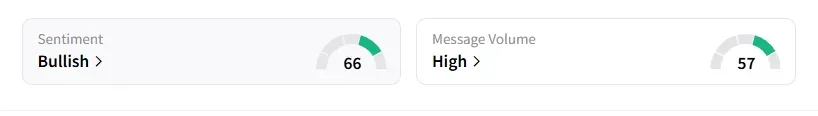

Data on Stocktwits shows that retail sentiment turned ‘bullish’ a day ago amid ‘high’ message volumes.

Technical Trends

On the technical side, PNB Housing is showing strong price action post-results, consolidating between ₹ 1,050 and ₹ 1,110 after a sharp rally from ₹750. The broader structure remains bullish.

Sahu recommended a buy between ₹1,070 and ₹1,086, with a stop-loss of ₹1,050 on a closing basis. Targets have been pegged at ₹1,110 and ₹1,175

With solid fundamentals backing its growth story and a bullish technical structure above ₹1,060, PNB Housing looks well-positioned for further upside, he concluded.

Analyst Vijay Kumar Gupta observed that the stock is rangebound near the top of a consolidation zone with low volatility. Its price compression indicates a possible buildup before a directional move, supported by stable fundamentals.

He flagged that the stock was hovering within a fair value gap near ₹1,080–₹1,090 zone. Other technical indicators, such as the Ichimoku cloud, show a bullish trend bias, with the price above the cloud. The Commodity Channel Index (CCI) has cooled off around 80, indicating temporary loss of momentum. While the Chaikin Money Flow is marginally positive, indicating muted but steady inflow.

Overall, Gupta's outlook is a sideways bias with mild bullish undertone as long as support levels hold. He identified sentiment drivers for the road ahead, including Strong FII flows and active re-rating of Housing Finance Companies (HFCs), which support stock performance, as well as stable asset quality metrics to build investor confidence.

Analyst Sunil Kotak flagged ₹1,150-₹1,170 as the supply zone for the stock.

PNB Housing shares have risen 24% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)