Advertisement|Remove ads.

Polestar Stock Gains Pre-Market After Securing $400M Bank-Backed Financing

- Alongside the equity purchase, both investors entered put option agreements with a wholly owned subsidiary of Geely Sweden Holdings AB.

- Feathertop Funding operates as a special-purpose vehicle consolidated into Sumitomo Mitsui Banking Corp.

- In December, the company announced a $300 million equity financing by Banco Bilbao Vizcaya Argentaria, S.A. and NATIXIS.

Polestar (PSNY) on Monday disclosed a fresh $400 million capital infusion that brings in some major banks as shareholders, strengthening the electric vehicle maker’s balance sheet at a critical point in its growth cycle.

The automaker confirmed it secured $400 million in equity financing, split evenly between Feathertop Funding and Standard Chartered Bank.

Equity Deal With Built-In Exit

Alongside the equity purchase, both investors entered put option agreements with a wholly owned subsidiary of Geely Sweden Holdings AB, which is part of its parent group. These arrangements allow banks to sell their stakes back after three years, subject to predefined return conditions, providing a structured exit if market conditions change.

Feathertop Funding operates as a special-purpose vehicle consolidated into Sumitomo Mitsui Banking Corp, effectively bringing two major financial institutions into Polestar’s ownership structure.

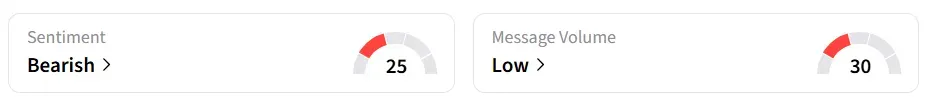

Following the announcement, Polestar stock traded over 2% higher in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘low’ message volume levels.

Why It Matters Now

Polestar framed the deal as a continuation of financing strategies it outlined previously, noting the terms closely resemble equity arrangements announced in December 2025.

“Following the new equity financing and the funding announcements in December, and with the support of Geely Holding, we continue to make progress on enhancing our liquidity position and strengthening our balance sheet.”

-Michael Lohscheller, CEO, Polestar.

In December, the company announced a $300 million equity financing by Banco Bilbao Vizcaya Argentaria, S.A. and NATIXIS. Additionally, Polestar said it signed a loan deal with a subsidiary of Geely Sweden Holdings, allowing it to borrow up to $600 million.

In 2025, Polestar’s retail sales jumped 34% year-on-year to 60,119 cars.

PSNY stock has declined by over 51% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)