Advertisement|Remove ads.

ProAssurance Jumps Premarket On $1.3B Take-Private Deal From The Doctors Company, Retail’s Exuberant

ProAssurance (PRA) stock jumped 50.6% in premarket trade after it agreed to be taken private by The Doctors Company in a $1.3 billion deal.

The companies said that under the deal terms, ProAssurance stockholders will receive $25 in cash per share, representing an approximately 60% premium to the company’s last closing price on March 18.

The combined company will have assets of about $12 billion, the specialty insurers said.

ProAssurance is a specialty insurer with expertise in medical professional liability and product liability for medical technology and life sciences.

“Bringing the strengths and capabilities of our companies together now will allow our teams to continue to serve today’s healthcare providers with the necessary scale and breadth of capabilities,” ProAssurance CEO Ned Rand said.

The deal is expected to close in the first half of 2026.

Houlihan Lokey Capital and Howden Capital Markets & Advisory are The Doctors Company's financial advisors, while Goldman Sachs & Co. is advising ProAssurance.

ProAssurance had topped fourth-quarter sales expectations in February.

The company had reported a net income of $16.2 million, or $0.31 per share, for the three months ended Dec. 31, compared with earnings of $0.12 per share in the year-ago quarter.

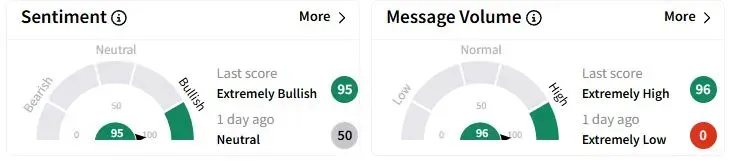

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (95/100) territory from ‘neutral’ (50/100) a day ago, while retail chatter rose to ‘extremely high’ levels.

One user thought the stock might trade at about $23 or lower until it gets closer to the closing of the deal.

ProAssurance shares have fallen 2.3% year-to-date (YTD).

Also See: APA Stock Rises After Reports Of Workforce Reduction, Retail’s Divided

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)