Advertisement|Remove ads.

Peloton Stock Gains Momentum, Retail Attention As Earnings Near: Here’s What Analysts Expect

Shares of Peloton Interactive, Inc. ($PTON) surged nearly 12% on Friday, drawing the attention of retail investors as well.

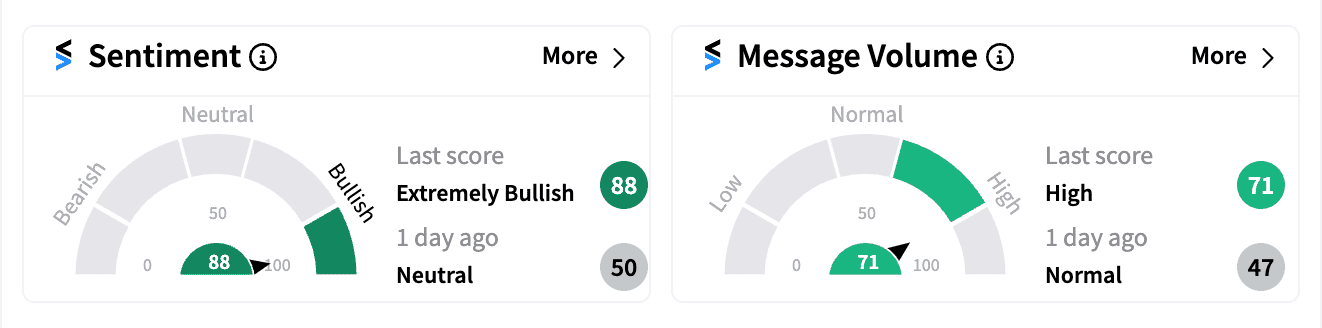

As of 11:00 AM ET, PTON ranked among the top five trending tickers on Stocktwits, with retail sentiment shifting to ‘extremely bullish’ (88/100) from ‘neutral’ the day before.

Peloton announced that it will release its fiscal Q1 2025 results before the U.S. stock market opens on Thursday, Oct. 31. The company will host a conference call and live audio webcast to discuss the results at 8:30 AM.

According to The Fly, bullish option activity was noted on Thursday, with 43,026 call options traded — twelve times the expected volume — leading to a 25-point increase in implied volatility, now at 133.49%.

The most active options included the Nov-24 $6 calls and Oct-24 $5.5 calls, with total volume in these strikes approaching 17,300 contracts. The Put/Call Ratio stands at 0.04.

Analysts predict Peloton will report a Q1 loss of $0.15 per share, an improvement from the $0.44 loss recorded in the same period last year.

Revenue is expected to decline to $573.26 million, down from $595.5 million year-over-year.

In August, Peloton posted Q4 results indicating its first quarterly revenue growth in 2.5 years, driven by a 2% increase in app subscription sales, which offset a 4% decline in hardware product revenue.

Despite these signs of recovery, Peloton faces challenges, including ongoing dips in sales of its signature bikes and treadmills, declining expectations for hardware and app subscribers amid economic uncertainties, and the search for a permanent CEO.

Market optimism has bolstered following recent management developments.

Earlier this month, Peloton announced a partnership with Truemed, which allows eligible U.S.-based customers to use pre-tax Health Savings Account (HSA) and Flexible Spending Account (FSA) dollars to purchase Peloton products at attractive prices.

BMO Capital has maintained a ‘Market Perform’ rating with a $6.50 price target on Peloton, noting that recent meetings with the company’s management were “upbeat.”

The discussions highlighted a balanced focus on sustainable profits while exploring growth opportunities, including Peloton’s new and improved product offerings like Strength+ (a collection of strength training programs and classes), pricing strategies, cost savings, instructor initiatives, and the ongoing CEO search.

So far this year, PTON stock has declined by over 0.15%.

Read next: Apple Stock Perks Up On iPhone China Sales Report: Retail Optimism Rises

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)