Advertisement|Remove ads.

Puma Retail Traders Turn Bearish After Report Of Owner Mulling Mega Stake Sale

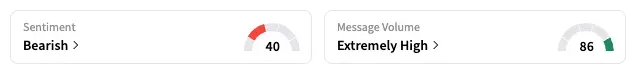

Retail sentiment for Puma's U.S. shares turned 'bearish' early Tuesday, after a Bloomberg report the previous day stated that its largest shareholder, the Pinault family, is in talks to sell its stake in the German sportswear giant.

On Stocktwits, the sentiment for those shares was 'neutral' before the report came in. Meanwhile, Puma's shares on the Frankfurt Stock Exchange surged 20%, the most since October 2001, but were down 2.4% in afternoon trading on Tuesday.

Bloomberg reported on Monday that the Pinault family, which owns a 29% stake in Puma through its investment holding company Artemis, has engaged financial advisors, possibly with a view to triggering a sale of the company.

The report, citing people familiar with the matter, stated that early talks had taken place with China's Anta Sports Products Ltd. and Li Ning Co. Feelers were also extended to U.S. sportswear firms and sovereign wealth funds in the Middle East.

The news comes as Puma faces waning demand for its merchandise, amid intense competition from Adidas and Nike, as well as fast-growing brands such as On and Hoka.

Puma reported 281.6 million euros (approximately $312 million) in net income and 8.8 billion euros in sales last year.

Until Friday, Puma's German shares had slumped by 50% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)