Advertisement|Remove ads.

Quantum BioPharma Heads For Best Week Ever — But Most Retail Traders Lament Missing Out On The Surge

Shares of Quantum BioPharma Ltd. slipped premarket Friday, but as of Thursday's close, the stock was on track for a staggering 366% weekly gain.

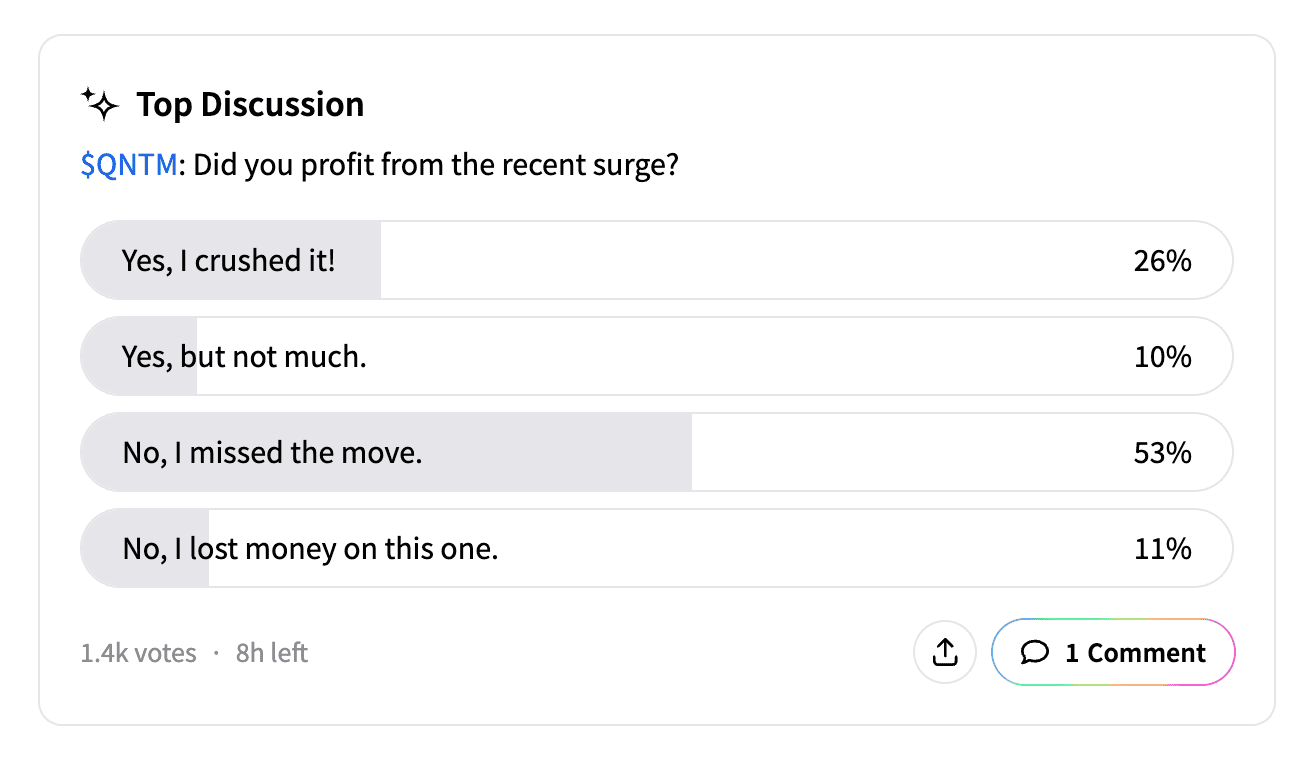

Despite the rally, a Stocktwits poll revealed that 55% of retail traders missed the move, while 26% said they profited and "crushed it." Meanwhile, 11% reported losing money on the stock.

The surge followed Tuesday's announcement that Quantum had completed a double-blind, randomized, placebo-controlled clinical trial evaluating its dietary supplement, Unbuzzd, for alcohol metabolism.

Key findings showed that Unbuzzd reduced blood alcohol concentration (BAC) over 40% faster within 30 minutes compared to control subjects, with effects lasting throughout the four-hour measurement period.

The supplement further reduced headache severity by 67% at four hours and continued to ease cognitive and physical impairment up to eight hours after consumption.

Adding to the bullish sentiment, Quantum on Thursday said that Celly Nutrition Corp., the company behind Unbuzzd, has engaged a leading New York investment bank to raise up to $10 million and explore an initial public offering on a major U.S. exchange, pending regulatory approval.

Quantum retains a 25.71% ownership stake in Celly Nutrition and earns a 7% royalty on Unbuzzd sales until total payments reach $250 million, after which royalties drop to 3% in perpetuity.

In December, Quantum BioPharma announced it had purchased $1 million worth of Bitcoin and other cryptocurrencies as part of its strategic efforts.

The stock's meteoric rise has driven a surge in retail interest. As of Thursday's close, Stocktwits message volume about Quantum skyrocketed 1,030 times over the past week,, while the company's follower count jumped nearly 19%.

Sentiment on the platform remains 'extremely bullish' compared to a week ago.

According to Koyfin data, Quantum ended the September quarter with $6.61 million in cash and investments and a total debt of approximately $370,000.

The stock has gained nearly 18% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233231242_jpg_8d76eb3b7a.webp)