Advertisement|Remove ads.

Quanta Services Stock Rallies On Strong Q4 Earnings, Outlook: Retail’s Excited

Infrastructure solutions provider Quanta Services (PWR) stock rose nearly 3% on Thursday morning after the company’s fourth-quarter earnings topped Street estimates.

Revenue rose 13% year-over-year (YoY) to $6.55 billion, falling short of an analyst estimate of $6.61 billion, according to FinChat data. Earnings per share (EPS) came in at $2.94, topping the Street’s estimate of $2.62.

Net income attributable to common stockholders increased 45% YoY to $305.12 million during the quarter.

CEO Duke Austin said the company expects another year of strong performance in 2025, including double-digit growth in revenue, adjusted earnings before interest, tax, depreciation, and amortization (EBITDA), and earnings per share, as well as the ability to achieve record backlog.

For 2025, Quanta expects revenues to range between $26.60 billion and $27.10 billion compared to a Street estimate of $26.89 billion. The company expects adjusted diluted EPS attributable to common stock to range between $9.90 and $10.50 versus an estimated $10.25.

Quanta expects EBITDA to range between $2.49 billion and $2.62 billion and adjusted EBITDA to range between $2.66 billion and $2.80 billion.

Net cash provided by operating activities is projected between $1.70 billion and $2.25 billion, while free cash flow is expected to range between $1.20 billion and $1.70 billion.

In February, Lumen Technologies, Inc. selected the company to provide construction services for long-haul fiber networks designed to transport data center traffic for technology companies between ten metro areas in the United States.

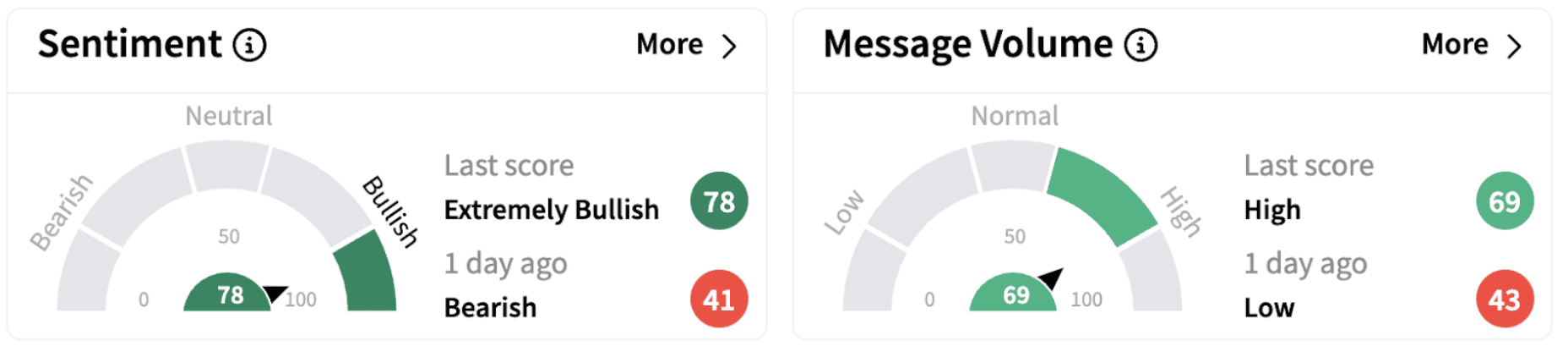

On Stocktwits, retail sentiment flipped into the ‘extremely bullish’ territory (78/100) from ‘bearish’ a day ago.

Retail chatter on Stocktwits indicated a positive sentiment on the stock.

Quanta shares have lost over 4% in 2025 but have gained over 44% over the past year.

Also See: Cheniere Energy Stock Draws Attention After Q4 Earnings Beat: But Retail’s Not Impressed Yet

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)