Advertisement|Remove ads.

QuantumScape Corp Fails To Attract Positive Retail Sentiment Despite Lucrative Volkswagen Deal

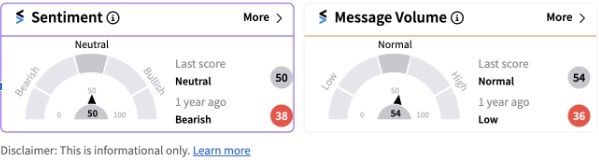

Retail sentiment for QuantumScape Corp remained neutral (50/100) on Stocktwits after the company entered into an agreement with Volkswagen Group’s battery company PowerCo to industrialize its next-generation solid-state lithium-metal battery technology. Shares of QuantumScape closed nearly 17% higher on Friday and have risen over 62% in the last month.

Under the terms of the agreement, PowerCo can manufacture up to 40 gigawatt-hours (GWh) per year using QuantumScape’s technology with the option to expand up to 80 GWh annually, which is enough to outfit close to one million vehicles per year. The firms believe this engagement represents the fastest way to achieve gigawatt-hour-scale production of solid-state technology to meet the growing global demand for better electric vehicle batteries.

QuantumScape said the agreement supersedes an earlier joint venture between it and Volkswagen Group to co-manufacture batteries.

Baird analyst Ben Kallo has expressed optimism about the deal, saying it provides royalty payments and a pathway to commercialization. The analyst believes that, given the company's work with many other car makers, additional partnership announcements may be a catalyst. The latest deal announcement comes as a relief for QuantumScape stock, which had taken a hit in January after a news report indicated that Volkswagen may be looking at other potential battery manufacturers.

Meanwhile, Truist analyst Jordan Levy reportedly said their firm will be looking for more details around timelines to initial production and other milestones that still need to be cleared. Levy believes the deal shows that an essential long-term partner and largest shareholder remains supportive of the firm’s commercialization efforts.

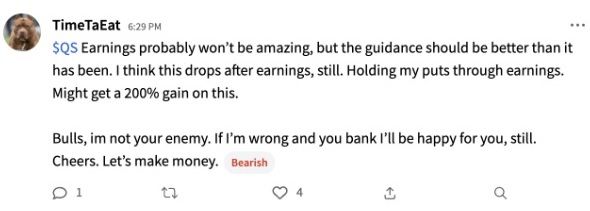

The company is scheduled to report its second-quarter earnings on July 24. One Stocktwits user named “TimeTaEat” has expressed skepticism on the upcoming results, one of many messages keeping overall sentiment in neutral range despite the positive news.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)