Advertisement|Remove ads.

Ray Dalio Says Moody’s Credit Warning Doesn’t Capture Full US Risk

Bridgewater Associates founder Ray Dalio warned on Monday that Moody’s recent downgrade of the U.S. sovereign credit rating is only the tip of the iceberg.

According to him, the credit risk is higher than the downgrade suggests.

On Friday, Moody’s lowered the U.S. credit rating to Aa1 from Aaa. “This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels significantly higher than similarly rated sovereigns,” the firm said in its rating action.

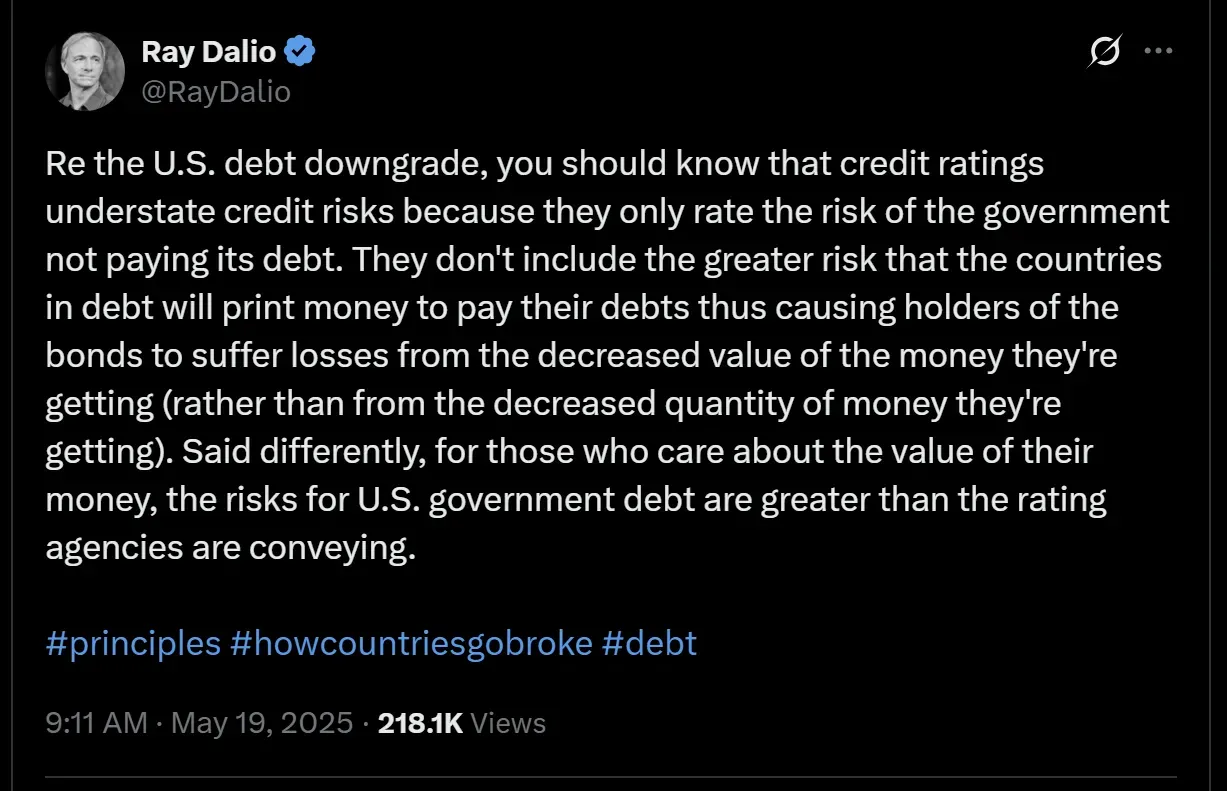

Dalio wrote in a post on X that the downgrade “understates” the true credit risk because it focuses solely on the government’s capacity to repay its debt. “They don’t include the greater risk that the countries in debt will print money to pay their debts, thus causing holders of the bonds to suffer losses from the decreased value of the money they’re getting.”

Standard & Poor’s, in August 2011, was the first of the three major credit-rating agencies to downgrade the U.S., which led to a brutal sell-off on Wall Street. In August 2023, Fitch also lowered its rating on U.S. debt to its second-highest level.

“Said differently, for those who care about the value of their money, the risks for U.S. government debt are greater than the rating agencies are conveying,” Dalio wrote.

U.S. stocks remained mixed in midday trade on Monday after the 30-year Treasury bond yield surged past 5% for the first time since April’s tariff announcement. The 10-year yield climbed 10 basis points to 4.521% in response to Moody’s downgrade.

The SPDR S&P 500 ETF Trust (SPY) was down 0.06%, and the Invesco QQQ Trust (QQQ), which tracks the Nasdaq 100, dropped 0.25%. Meanwhile, the SPDR Dow Jones Industrial Average ETF (DIA) edged 0.04% higher.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Google Quietly Tests Discover On Desktop For Select Users Ahead Of I/O Conference

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)