Advertisement|Remove ads.

RBC Flags Cloudflare As ‘Tier 1’ AI Beneficiary – Attributes Share Price Surge To Buzz Around Growing Demand For AI Workloads

- According to analyst Matthew Hedberg, the broader expansion of AI applications strengthens the company’s position.

- RBC Capital reiterated an ‘Outperform’ rating on the stock, with a price target of $265.

- TD Cowen said that the company’s infrastructure, including the Cloudflare Tunnel, allows developers to safely connect locally run AI tools to the internet.

RBC Capital said Cloudflare Inc.’s (NET) notable surge in stock price is driven by investor enthusiasm surrounding the growing demand for AI workloads, and added that emerging AI projects such as Anthropic’s Claude Code, Cowork, and the open-source Clawdbot are fueling interest in the company’s capabilities.

The company is scheduled to report its fourth-quarter (Q4) earnings on February 10. Analysts expect a Q4 revenue of $591.36 million and earnings per share (EPS) of $0.27, according to Fsical AI data.

AI Growth And Cloudflare’s Role

According to analyst Matthew Hedberg, while these specific AI initiatives are “not likely needle movers” for Cloudflare in the near term, the broader expansion of AI applications strengthens the company’s position, according to TheFly.

Hedberg highlighted Cloudflare as a “Tier 1 AI winner,” citing opportunities in AI inference, the flexibility of its Workers platform, and the newly introduced pay-per-crawl model as key drivers of future growth.

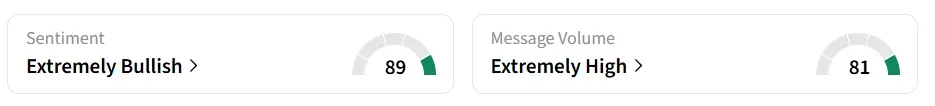

RBC Capital reiterated an ‘Outperform’ rating on the stock, with a price target of $265. Cloudflare stock traded over 13% higher on Tuesday morning. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory while message volume shifted to ‘extremely high’ from ‘normal’ levels in 24 hours.

TD Cowen Echoes View

According to TD Cowen, the online buzz over Clawdbot over the weekend encouraged investors to link the momentum of AI tools to Cloudflare’s capabilities in supporting and securing AI agents.

The firm added that the company’s infrastructure, including the Cloudflare Tunnel, allows developers to safely connect locally run AI tools to the internet without exposing sensitive servers.

Cloudflare’s ability to combine secure connectivity with scalable infrastructure positions it as an important player for enterprises adopting AI across sectors such as software, automation, and robotics.

NET stock has gained 70% in the last 12 months.

Also See: Amazon Closes Its Fresh Grocery And Go Stores To Focus On Whole Foods Growth

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)